As a teenager navigating the world of car ownership and insurance, I understand the challenges you face. The thought of securing affordable car insurance in Pennsylvania can feel daunting, but I’m here to help. In this comprehensive guide, I’ll share my personal insights and practical strategies to ensure you get the best PA car insurance quotes tailored to your needs as a teen driver.

Understanding the PA Car Insurance Essentials

When it comes to car insurance in Pennsylvania, there are a few key requirements you need to know. The state mandates that all drivers, including teens, maintain a minimum level of coverage. Let’s dive into the specifics:

Bodily Injury Liability

This coverage pays for injuries to others if you’re found at fault in an accident. The minimum requirement in PA is $15,000 per person and $30,000 per accident. As a teen driver, you can expect to pay around $500 to $800 per year for this coverage.

Property Damage Liability

This coverage protects you if you’re responsible for damage to someone else’s property, such as their vehicle, in an accident. The minimum requirement in PA is $5,000 per accident, and for teen drivers, it typically costs $200 to $400 per year.

Medical Benefits

Medical benefits coverage pays for your own medical expenses after an accident, regardless of fault. The minimum requirement in PA is $5,000, and for teen drivers, this coverage usually costs $100 to $300 per year.

While meeting the legal minimums is essential, I highly recommend adding additional coverage, such as uninsured/underinsured motorist (UM/UIM) protection. UM/UIM safeguards you if you’re hit by a driver with inadequate or no insurance, providing valuable peace of mind for teen drivers like yourself.

Factors Influencing Your PA Car Insurance Quotes

As a teen driver, several key factors can significantly impact the cost of your PA car insurance quotes. Understanding these elements can help you make informed decisions and potentially save money.

Driving Record

Your driving record is one of the most critical factors in determining your car insurance rates. Violations like speeding tickets, accidents, and DUI convictions can lead to substantial increases, sometimes doubling or even tripling your premiums. Maintaining a clean driving record is crucial.

Age

Insurance companies view teen drivers as a higher-risk group, statistically more likely to be involved in accidents. On average, a 16-year-old driver in Pennsylvania can expect to pay around $2,989 per year for a full coverage policy, compared to $789 for a 22-year-old.

Vehicle

The type of car you drive can also influence your insurance costs. Sports cars, luxury vehicles, and high-performance models generally have higher premiums due to their increased repair and replacement costs. Choosing a safe, affordable vehicle can help you save.

Location

Where you live in Pennsylvania can also play a role in your car insurance rates. Urban areas with higher traffic density and crime rates tend to have higher average premiums compared to suburban or rural locations.

Credit Score

Insurers in Pennsylvania may use your credit score as a factor in determining your car insurance rates. Drivers with poor credit scores can expect to pay significantly more than those with good credit.

By understanding these factors, you can actively work to improve your standing and position yourself for the best possible PA car insurance quotes as a teen driver.

Strategies for Finding Affordable PA Car Insurance

Now that you’re aware of the key factors affecting your car insurance costs, let’s explore practical strategies to secure the most affordable PA car insurance quotes.

Comparing Quotes

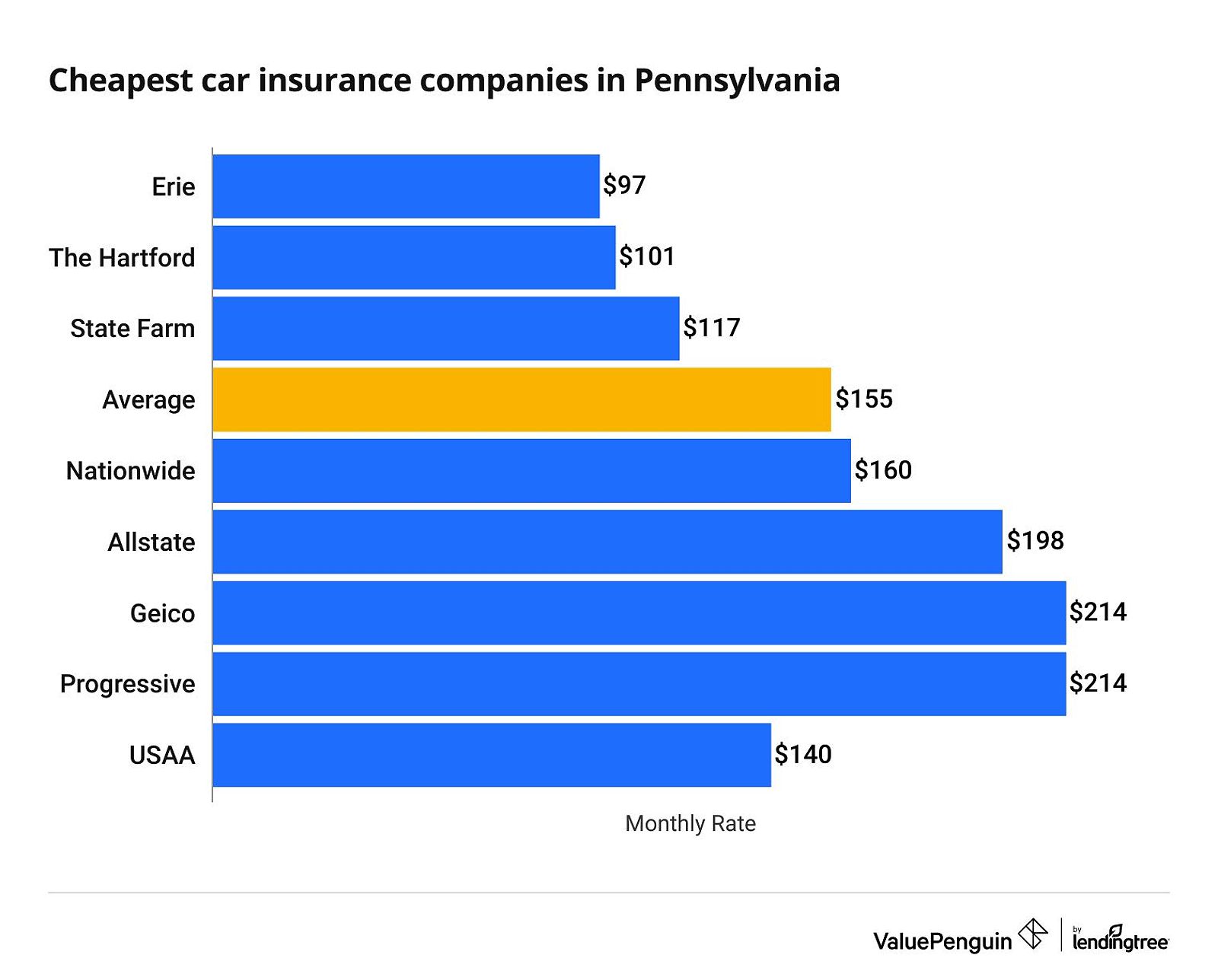

Comparing quotes from multiple insurance providers is essential to find the best rates. I recommend using online comparison tools or contacting insurance agents directly to get personalized quotes. Some reputable companies to consider in Pennsylvania include Erie, Nationwide, and Travelers.

Maximizing Discounts

As a teen driver, you have access to various discounts that can significantly reduce your car insurance costs. Look for opportunities such as good student discounts, driver’s education discounts, safe driver discounts, and multi-car discounts. These can potentially save you hundreds of dollars per year.

Balancing Coverage Options

When selecting your coverage, aim to strike a balance between your needs and your budget. While the minimum coverage may be more affordable, adding comprehensive and collision coverage can provide valuable protection for your vehicle. Carefully weigh the pros and cons to find the right coverage for your situation.

Tips for Saving on PA Car Insurance Quotes

To further optimize your PA car insurance rates as a teen driver, consider the following tips:

- Maintain a clean driving record: Avoid traffic violations and accidents, and consider taking a defensive driving course to demonstrate your commitment to safe driving.

- Choose a safe, affordable vehicle: Select a car with good safety ratings and lower repair costs to keep your insurance premiums in check.

- Bundle your policies: Combining your car insurance with other policies, such as homeowners or renters insurance, can often result in discounts.

- Shop around regularly: Compare quotes from different insurance providers at least once a year to ensure you’re getting the best rates.

- Consider adding to a parent’s policy: In many cases, being added to a parent’s car insurance policy can be more affordable than obtaining a separate policy as a teen driver.

The Impact of Driving Habits on PA Car Insurance Rates

In addition to the factors mentioned earlier, your driving habits can also significantly influence your PA car insurance quotes as a teen driver. Developing responsible behaviors behind the wheel can go a long way in securing lower premiums and maintaining a clean driving record.

Distracted Driving

Engaging in distracted behaviors, such as using a mobile device or focusing on non-driving tasks, can increase your risk of accidents. Insurance companies view distracted driving as a significant risk factor and may charge higher rates for drivers who exhibit this behavior.

Speeding and Reckless Driving

Exceeding the speed limit or engaging in other reckless driving maneuvers can also lead to higher car insurance costs. Insurance providers typically view these actions as indicators of increased risk, resulting in higher premiums.

Impaired Driving

Driving under the influence of alcohol or drugs is not only illegal but also drastically increases your chances of being involved in an accident. Insurers will likely charge significantly higher rates for drivers with a history of impaired driving, if they’re willing to provide coverage at all.

By prioritizing safe, responsible driving habits, you can demonstrate to insurance providers that you’re a low-risk driver, potentially earning you more favorable rates.

FAQ

Q: How much does car insurance cost for a teen driver in PA? A: The average cost of car insurance for a teen driver in Pennsylvania can vary significantly, but you can expect to pay higher premiums than older, more experienced drivers. On average, a 16-year-old driver may pay around $2,989 per year for a full coverage policy.

Q: What are some common discounts for teen drivers in Pennsylvania? A: Common discounts for teen drivers in PA include good student discounts, driver’s education discounts, safe driver discounts, and multi-car discounts. These can potentially save you hundreds of dollars per year on your car insurance.

Q: What happens if I get a ticket or have an accident as a teen driver? A: Having a ticket or accident on your driving record will significantly increase your car insurance rates in Pennsylvania. It’s crucial to drive safely and avoid any violations to maintain the best possible rates.

Q: Can I get car insurance without a driver’s license? A: Typically, you’ll need a valid driver’s license to obtain car insurance in Pennsylvania. However, if you don’t own a car but occasionally drive, you may be able to get a non-owner car insurance policy to provide liability coverage.

Conclusion

As a teen driver in Pennsylvania, finding the best car insurance quotes can be a daunting task, but it’s an essential step in your journey towards responsible and affordable transportation. By understanding the key factors that influence your rates, leveraging available discounts, and comparing quotes from multiple providers, you can secure the coverage you need at a price that fits your budget.

Remember, your driving habits and decisions play a crucial role in determining your insurance costs. Maintain a clean driving record, choose a safe and affordable vehicle, and prioritize responsible behaviors behind the wheel. By taking these proactive steps, you’ll position yourself for the most favorable PA car insurance quotes and ensure your peace of mind on the road.

Start your search today and take control of your car insurance costs. With the right knowledge and strategies, you can navigate the world of PA car insurance as a teen driver and find the coverage that best suits your needs.