In the fast-paced world of personal finance, the burden of high-interest debts can feel overwhelming, casting a dark shadow over one’s financial future. However, for those seeking to reclaim their financial autonomy, debt consolidation loans usa offer a glimmer of hope. This article will explore the strategic advantages of these specialized loans and how they can empower individuals in their quest to rebuild their credit and achieve long-term financial stability.

The Emancipating Power of Debt Consolidation Loans USA

Imagine a scenario where you’re trapped in a maze of multiple debts, each with its own due date, interest rate, and payment structure. The constant juggling act can be mentally taxing, and the ever-growing interest charges can feel like a weight that’s slowly crushing your financial dreams. Enter debt consolidation loans — the financial equivalent of a master key that can unlock the door to a more streamlined and manageable debt landscape.

Checking multiple bills

Checking multiple bills

By combining multiple debts into a single, fixed-rate loan, individuals can simplify their monthly obligations, potentially lower their interest charges, and regain a sense of control over their finances. This transformative process not only alleviates the stress of juggling multiple payments but also sets the stage for credit score improvement, a crucial element in the journey towards financial independence.

Decoding the Mechanics of Debt Consolidation

The mechanics of debt consolidation loans are relatively straightforward, yet their impact can be profound. Imagine yourself in the shoes of someone seeking to consolidate their debts. The process begins with a thorough assessment of your existing obligations, including credit card balances, personal loans, and any other outstanding debts. Armed with this information, you’ll then apply for a new loan, often with a lower interest rate, that will cover the total amount owed.

Assessing debts

Assessing debts

Once approved, the lender will provide the necessary funds to pay off your existing debts, leaving you with a single, more manageable monthly payment. This streamlining of your obligations can not only ease the mental burden but also potentially save you money on interest charges over the life of the loan.

The Credit-Building Equation

The impact of debt consolidation loans on your credit score is a complex interplay of both positive and negative factors. The initial application for the loan will result in a hard credit inquiry, which can temporarily lower your score. However, the true power of debt consolidation lies in its long-term benefits.

By making consistent, on-time payments on the consolidated loan, you can gradually improve your credit utilization ratio and payment history — two crucial factors in determining your credit score. Additionally, the closure of the accounts you paid off with the consolidation loan may negatively impact your credit history and length of credit, so it’s essential to weigh these trade-offs carefully.

Navigating the Pros and Cons

As with any financial decision, debt consolidation loans come with their own set of advantages and drawbacks. Understanding these nuances is crucial in determining whether this strategy aligns with your unique financial goals and circumstances.

On the positive side, debt consolidation loans can offer lower monthly payments, the potential for reduced interest rates, and a streamlined debt management process. For individuals struggling to keep up with multiple high-interest debts, these benefits can be truly transformative.

Happy customer

Happy customer

However, it’s essential to be aware of the potential pitfalls. The initial hard credit inquiry can temporarily lower your credit score, and if your credit profile is less than stellar, you may not qualify for the most favorable interest rates. Additionally, the closure of paid-off accounts can have a detrimental impact on your credit history and length of credit.

Selecting the Right Debt Consolidation Loan

When navigating the landscape of debt consolidation loans in the USA, it’s crucial to approach the process with a discerning eye. Several key factors should be at the forefront of your decision-making:

- Interest Rates: Comparing the interest rates offered by different lenders is essential to ensure you’re getting the best deal.

- Loan Terms: Evaluating the repayment period is crucial, as longer terms may result in lower monthly payments but higher overall interest paid.

- Fees: Be mindful of any origination fees, late payment fees, or prepayment penalties that may be associated with the loan.

- Lender Reputation: Researching the lender’s reputation and customer reviews can help you ensure a positive experience.

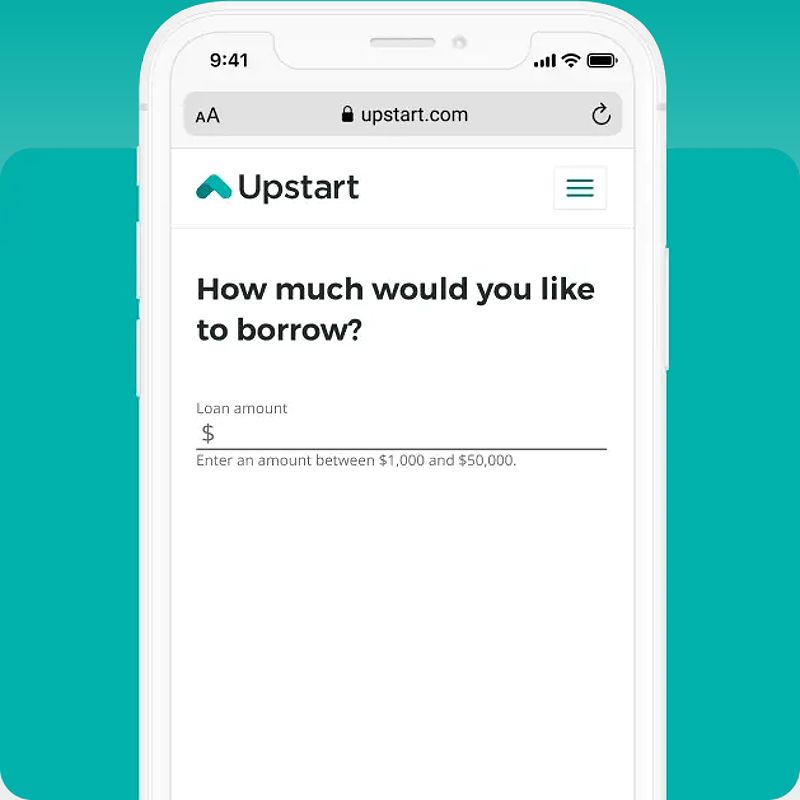

Upstart loan process

Upstart loan process

Empowering Your Credit-Building Journey

To maximize the benefits of a debt consolidation loan and pave the way for long-term financial success, it’s essential to adopt a strategic and disciplined approach. Here are some key steps to consider:

- Set Realistic Goals: Establish achievable targets for debt reduction and credit score improvement.

- Create a Budget: Develop a comprehensive budget to track your expenses and ensure timely loan payments.

- Avoid New Debt: Refrain from using credit cards or taking on additional loans while consolidating your existing debt.

- Make Extra Payments: Consider making additional payments on the consolidation loan to accelerate debt repayment and minimize interest charges.

- Monitor Your Credit: Regularly check your credit score to track your progress and identify any potential issues.

- Seek Professional Guidance: Consider consulting with a financial advisor or credit counselor for personalized advice on your debt consolidation and credit-building journey.

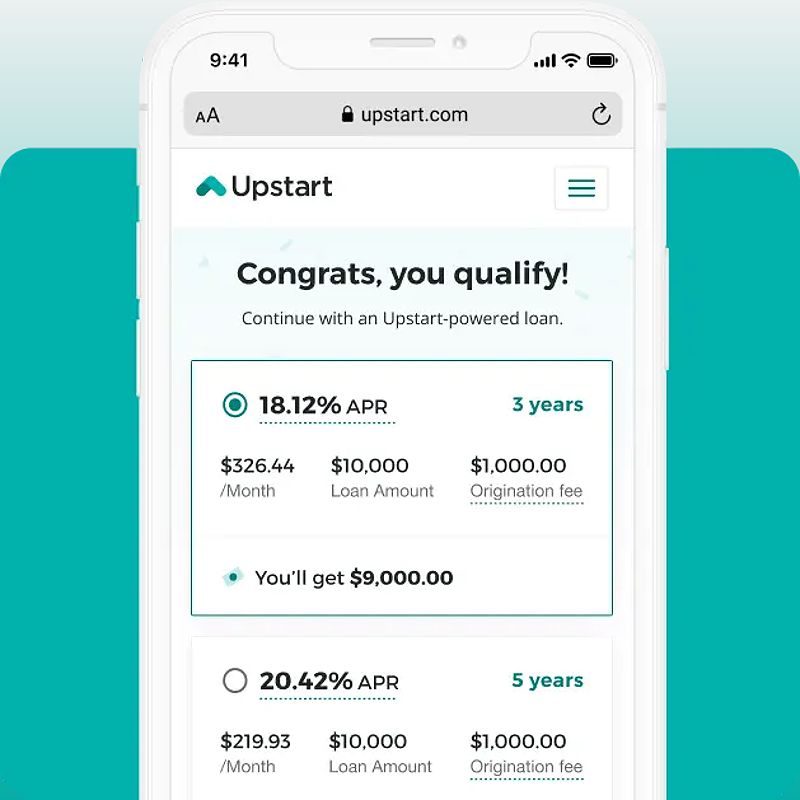

Loan funded

Loan funded

A Transformative Case Study: Jessicas Journey

In the summer of 2024, Jessica, a young professional struggling with the weight of her student loans and credit card debt, decided to take control of her financial future. Overwhelmed by the juggling act of multiple payments and the ever-increasing interest charges, she set out to explore the world of debt consolidation loans.

After thorough research and careful consideration, Jessica opted for a reputable lender that specialized in working with individuals like herself, who were determined to rebuild their credit. The lender offered her a debt consolidation loan with a fixed interest rate that was significantly lower than what she had been paying on her various debts.

By consolidating her obligations into a single, manageable monthly payment, Jessica was able to free up funds that she could then allocate towards accelerating her debt repayment. Over the course of the next two years, she made every single payment on time, diligently avoiding the temptation to accumulate new debt.

“Signing up for a debt consolidation loan was a game-changer for me,” Jessica reflected. “It allowed me to simplify my finances, save on interest, and focus on regaining control of my credit. The journey hasn’t been easy, but the sense of empowerment I feel now is truly priceless.”

Frequently Asked Questions

Q: What is a hard credit inquiry, and how does it impact my credit score? A: A hard credit inquiry occurs when a lender checks your credit history to assess your creditworthiness. This type of inquiry can temporarily lower your credit score, but the impact is typically short-lived.

Q: How often should I check my credit score? A: It’s recommended to check your credit score at least once a year, but more frequent monitoring can be beneficial for individuals actively building their credit.

Q: What are some signs that a debt consolidation loan may not be the best option for me? A: If you have a low credit score, are struggling to make your current debt payments, or are likely to accumulate new debt, a debt consolidation loan may not be the most suitable solution.

Q: What are some alternatives to debt consolidation loans? A: Alternatives to debt consolidation loans include balance transfer credit cards, debt management plans, and credit counseling services.

Embracing the Path to Financial Empowerment

In the ever-evolving landscape of personal finance, debt consolidation loans in the USA have emerged as a powerful tool for individuals seeking to regain control of their financial destiny. By understanding the intricacies of these specialized loans, evaluating the pros and cons, and adopting a strategic approach, you can embark on a transformative journey towards credit-building and long-term financial stability.

As you navigate this path, remember that financial empowerment is not a destination, but a continuous process of education, discipline, and self-discovery. By leveraging the insights and strategies outlined in this article, you can confidently take the first steps towards a future free from the shackles of high-interest debt, ultimately paving the way for a brighter, more financially secure tomorrow.