Are you struggling with high-interest private student loans? Consolidating and refinancing private student loans can be a powerful tool for reducing your monthly payments and saving money on interest. This comprehensive guide will provide you with the information you need to make an informed decision about refinancing your private student loans.

Understanding the Benefits of Refinancing

Refinancing your private student loans involves replacing your existing loans with a new loan, often at a lower interest rate. This can lead to significant savings on interest payments over the life of the loan.

Refinancing private student loans

Refinancing private student loans

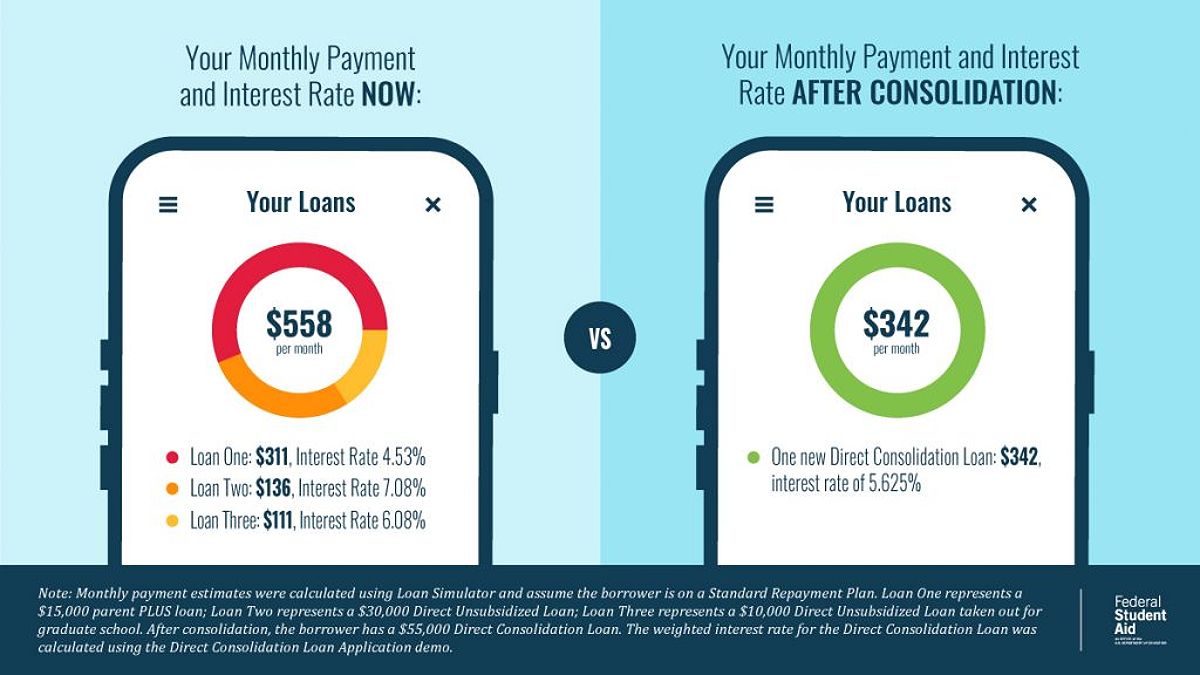

Lower Monthly Payments when You Consolidate and Refinance Private Student Loans

One of the most immediate benefits of refinancing is the potential to reduce your monthly payments. This can free up cash flow in your budget, allowing you to allocate those savings towards other financial goals, such as building an emergency fund, investing, or even enjoying life’s pleasures.

Lower monthly payments

Lower monthly payments

Reduced Interest Costs

By securing a lower interest rate, you’ll pay less in interest over the life of your loan. This can translate into thousands of dollars in savings, which can be used to accelerate your debt repayment or invest in your future.

Reduced interest costs

Reduced interest costs

Faster Debt Elimination

With lower interest costs and monthly payments, you can make larger principal payments and pay off your debt more quickly. This can help you achieve financial freedom sooner, opening up new opportunities and reducing the stress and burden of student loan debt.

The Refinancing Process: A Step-by-Step Guide

The process of refinancing private student loans is generally straightforward, but it’s important to understand the steps involved. Here’s a detailed guide to help you navigate the refinancing process.

1- Check Your Credit Score

Before you start applying for refinancing, it’s essential to check your credit score. Lenders will use your credit score to determine your eligibility for refinancing and the interest rate they offer. If your credit score has improved since you took out your original loans, you may be able to secure a lower interest rate.

2- Research and Compare Lender Offerings

Once you know your credit score, begin researching and comparing offers from different lenders. Look for lenders that offer competitive interest rates, flexible repayment terms, and minimal fees. Use online tools and rate comparison websites to simplify this process and find the best fit for your financial situation.

3- Gather the Required Documentation

When you’re ready to submit your application, you’ll need to have certain documents on hand, such as proof of income, bank statements, and details about your existing student loans. Gathering these documents in advance can help streamline the application process.

4- Submit Your Application and Review the Loan Agreement

Once you’ve chosen a lender, submit your application and wait for the approval. When you receive the loan agreement, carefully review the terms, including the interest rate, repayment schedule, and any associated fees. This step is crucial to ensure you understand the full implications of the refinancing and that it aligns with your financial goals.

Optimizing Your Refinancing Strategy

To maximize the benefits of refinancing your private student loans, consider the following strategies:

Selecting the Optimal Loan Term

When choosing the length of your new loan term, you’ll need to balance the interest rate and the monthly payment. Shorter loan terms typically come with lower interest rates but higher monthly payments, while longer terms result in lower monthly payments but potentially higher overall interest costs. Carefully assess your budget and financial goals to determine the best loan term for your situation.

Fixed vs- Variable Interest Rates

You’ll also need to decide between a fixed or variable interest rate. A fixed interest rate provides stability and predictability, as your rate will remain the same throughout the life of the loan. A variable interest rate may start lower but can fluctuate over time, potentially leading to higher interest costs in the long run. Consider your risk tolerance and the potential for future market changes when making this decision.

Understanding Fees and Costs

Be sure to review the fine print and understand any fees associated with the refinancing process, such as origination fees, application fees, or prepayment penalties. Compare the total costs across different lenders to find the option that best fits your financial needs.

Potential Pitfalls to Consider

While refinancing can be a powerful tool for saving money, it’s important to be aware of potential drawbacks and limitations.

Federal Loan Forgiveness Programs

If you have federal student loans and are eligible for or currently enrolled in a federal loan forgiveness program, such as Public Service Loan Forgiveness (PSLF), refinancing may disqualify you from these benefits. Carefully evaluate your eligibility for these programs before proceeding with refinancing.

Federal loan forgiveness programs

Federal loan forgiveness programs

Creditworthiness and Interest Rates

Your credit score will play a significant role in determining your eligibility for refinancing and the interest rate you’ll be offered. If your credit score has declined since you took out your original loans, you may not qualify for a lower interest rate, and refinancing may not provide the desired savings.

Fees and Additional Costs

Some lenders may charge origination fees, application fees, or prepayment penalties. Be sure to compare the total costs associated with different refinancing options to find the most cost-effective solution.

Fees and additional costs

Fees and additional costs

Navigating the Potential Pitfalls

While the benefits of refinancing can be significant, it’s important to carefully consider the potential drawbacks and limitations.

Federal Loan Forgiveness Programs

If you have federal student loans and are eligible for or currently enrolled in a federal loan forgiveness program, such as Public Service Loan Forgiveness (PSLF), refinancing may disqualify you from these benefits. Carefully evaluate your eligibility for these programs before proceeding with refinancing.

Creditworthiness and Interest Rates

Your credit score will play a significant role in determining your eligibility for refinancing and the interest rate you’ll be offered. If your credit score has declined since you took out your original loans, you may not qualify for a lower interest rate, and refinancing may not provide the desired savings.

Fees and Additional Costs

Some lenders may charge origination fees, application fees, or prepayment penalties. Be sure to compare the total costs associated with different refinancing options to find the most cost-effective solution.

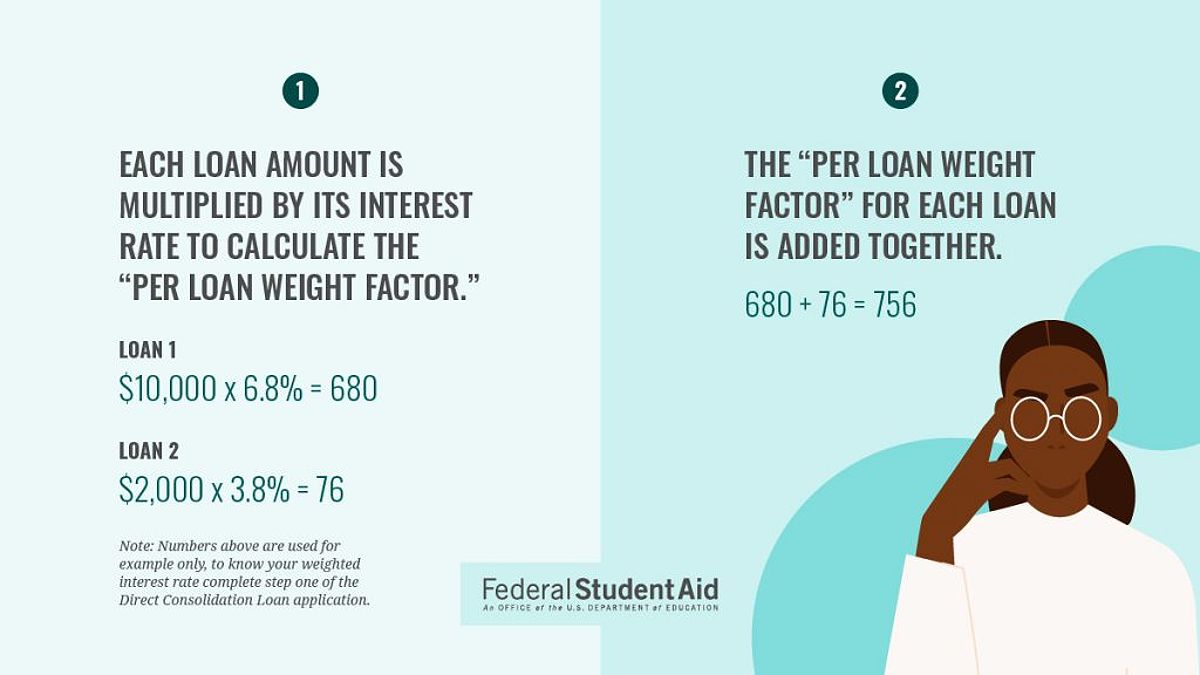

Q: Whats the difference between consolidating and refinancing student loans?

A: Consolidation involves combining multiple federal student loans into a single new loan, typically with a new interest rate. Refinancing, on the other hand, is the process of taking out a new loan from a private lender to pay off your existing student loans, both federal and private.

Q: Can I refinance my student loans if I have bad credit?

A: Refinancing with bad credit can be challenging, but it’s not impossible. You may need to apply with a cosigner who has good credit or work on improving your own credit score before applying for refinancing.

Q: What happens if interest rates rise after I refinance?

A: If you choose a fixed-rate refinancing loan, your interest rate will remain the same regardless of market fluctuations. However, if you opt for a variable-rate loan, your interest rate could increase over time as market conditions change.

Conclusion

Refinancing your private student loans can be a smart financial decision that can lead to significant savings and faster debt elimination. By understanding the benefits, navigating the refinancing process, and considering the potential pitfalls, you can make an informed choice that aligns with your long-term financial goals.

Remember, the key to a successful refinancing experience is to carefully compare lenders, review the terms and conditions, and choose the option that best fits your unique financial situation. With the right strategy and a little diligence, you can take control of your student loan debt and pave the way for a brighter financial future.