Starting a new business is an exciting and overwhelming experience. There’s a lot to think about, from developing your product or service to building your team. But amidst the excitement, it’s crucial to remember the importance of protecting your business with the right insurance coverage. I’ve been in your shoes, navigating the complex world of business insurance, searching for the perfect balance between affordable protection and comprehensive coverage. This guide will help you understand the secrets of cheap insurance for business and find the right policy for your needs.

Understanding the Essentials of Business Insurance

Let’s start with the basics. Business insurance is like a safety net for your venture – it shields your company from the financial consequences of unexpected events, whether it’s a customer injury, property damage, or a pesky lawsuit. At the heart of most business insurance policies is general liability insurance, which safeguards your company against third-party claims.

Now, I know what you’re thinking – insurance can be a real pain in the neck, right? But hear me out. Without adequate coverage, a single incident could potentially cripple your startup, jeopardizing everything you’ve worked so hard to build. Trust me, you don’t want to find out the hard way how much a lawsuit or accident can cost. By investing in the right insurance, you can rest easy, knowing your business is protected, allowing you to focus on growth and success.

Finding the Best Cheap Insurance for Your Business

The cost of business insurance can vary quite a bit, depending on factors like your industry, location, and the size of your operation. But don’t worry, with a little elbow grease and some strategic planning, you can find affordable coverage that meets your needs.

Shop Around and Compare Quotes

One of the best ways to score cheap insurance for your business is to compare quotes from multiple providers. This allows you to explore different coverage options and find the most competitive rates. Online platforms like Insureon make this process a breeze by providing a simple application that retrieves quotes from top-rated insurers. Just sit back, relax, and let the quotes roll in!

Bundle Policies for Savings

Another trick up my sleeve? Bundling your business insurance policies. Many insurance companies offer discounts when you combine coverage types, like general liability and commercial property insurance, into a business owner’s policy (BOP). Not only does this simplify your insurance management, but it can also lead to some serious cost savings.

Optimize Your Coverage Limits and Deductibles

When it comes to your insurance policy, the coverage limits and deductibles you choose can have a big impact on your premiums. While it might be tempting to go for lower limits to save a few bucks, it’s important to find the right balance between coverage and cost. Work closely with your insurance agent to determine the appropriate limits and deductibles that protect your business without breaking the bank.

Manage Your Risks

Your claims history and risk management practices can also influence the cost of your business insurance. By implementing safety protocols, training your employees, and maintaining a secure work environment, you can demonstrate to insurers that your business is a low-risk investment, potentially leading to lower premiums. It’s all about showing those insurance companies that you’re a responsible, safety-conscious business owner.

Essential Business Insurance for Startups

As a new business owner, there are a few key insurance policies you should have on your radar:

General Liability Insurance

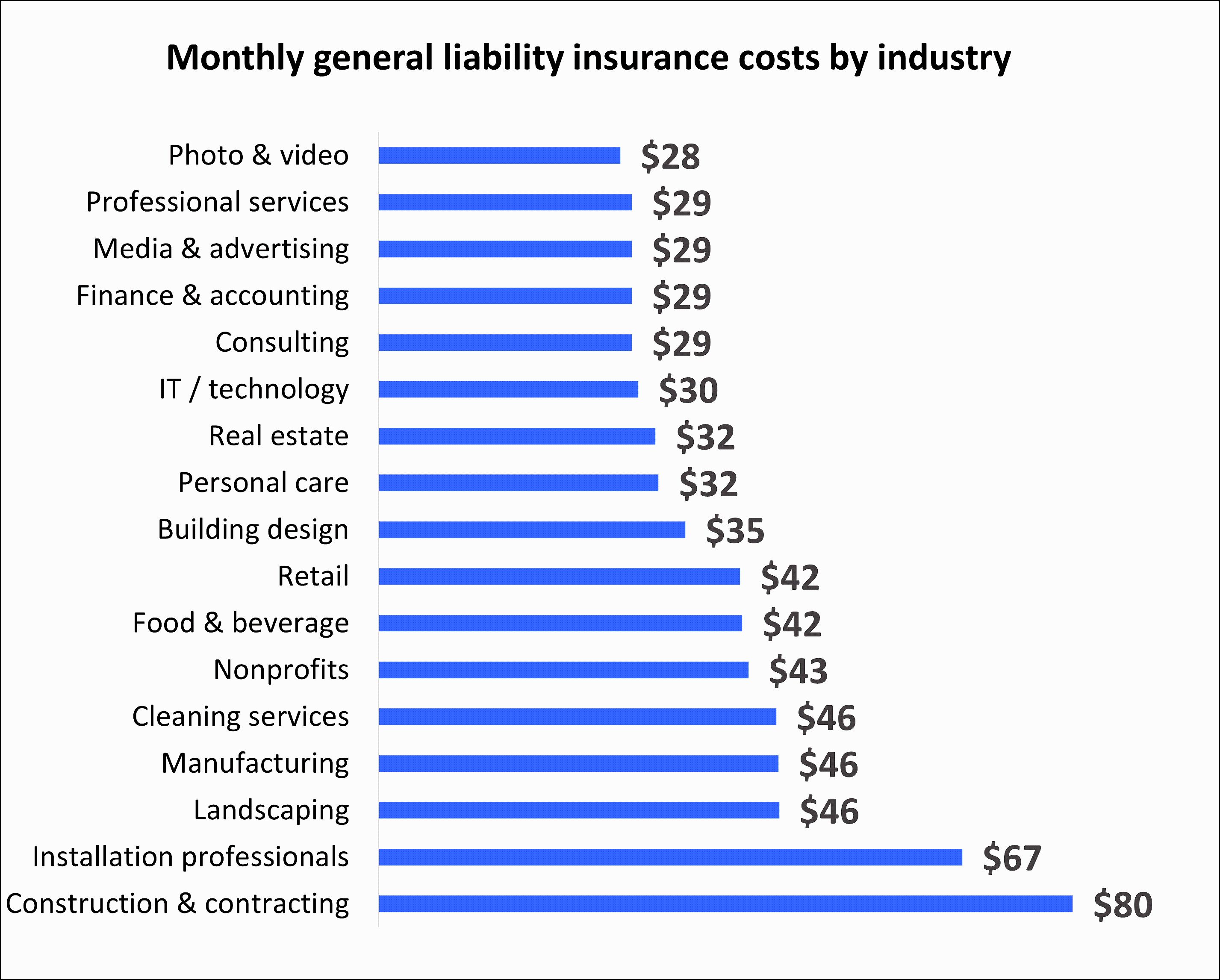

General liability insurance is the foundation of any solid business insurance plan. It covers claims of bodily injury, property damage, and personal/advertising injury, protecting your company from the financial consequences of accidents and lawsuits. Think of it as your trusty sidekick, always there to have your back.

Workers’ Compensation Insurance

If you have employees (and let’s be honest, you probably do), workers’ compensation insurance is a legal requirement in most states. This coverage protects your team by covering medical expenses and lost wages resulting from work-related injuries or illnesses. It’s like a safety net for your employees, giving you and them peace of mind.

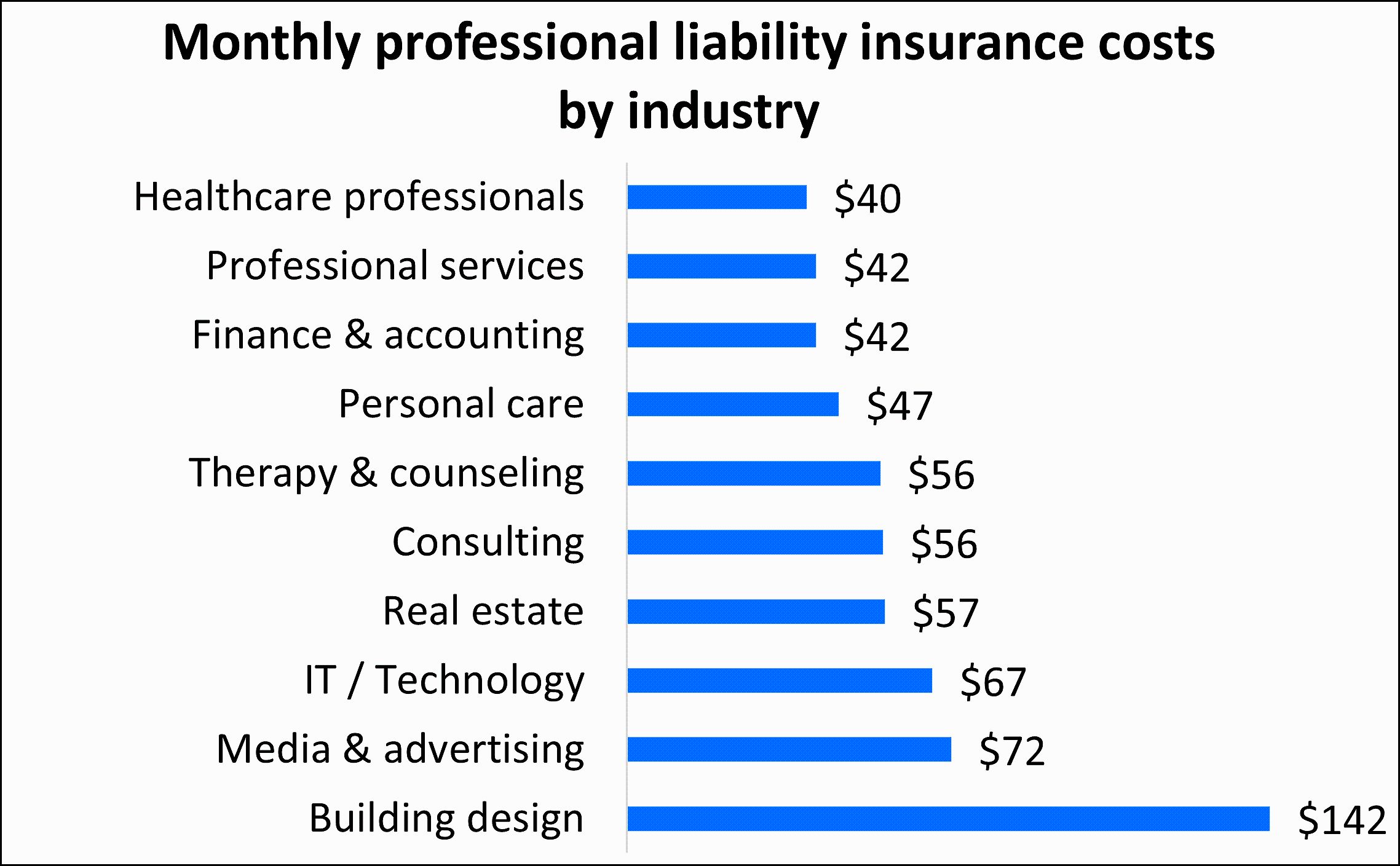

Professional Liability Insurance (Errors and Omissions)

For businesses that offer professional services, professional liability insurance, also known as errors and omissions (E&O) insurance, is a must-have. This policy safeguards your company against claims of negligence, mistakes, or failure to deliver professional services as promised. It’s your insurance superhero, swooping in to save the day when things don’t go as planned.

Commercial Property Insurance

Protecting your physical assets, like your office, equipment, and inventory, is crucial. Commercial property insurance covers the cost of repairing or replacing your business property in the event of a covered loss, such as a fire, theft, or natural disaster. It’s like a guardian angel watching over your most valuable business possessions.

Risk Management for Lower Insurance Costs

Now, I know what you’re thinking – “Great, more things to worry about!” But hear me out. Implementing effective risk management strategies can actually help lower the cost of your business insurance. By proactively addressing potential sources of liability and minimizing claims, you can demonstrate to insurers that your business is a lower risk, which can lead to more affordable premiums.

Create a Safe Work Environment

Ensuring a safe work environment for your employees and customers is a key aspect of risk management. This includes implementing safety protocols, conducting regular inspections, and providing appropriate training to your team. It’s all about showing those insurance companies that you take safety seriously.

Establish Clear Communication Policies

Effective communication with your clients and customers can help prevent misunderstandings and reduce the risk of errors or disputes that could lead to lawsuits. Consider implementing clear policies and procedures for handling customer interactions and documentation. It’s like a communication superhighway, keeping everyone on the same page.

Invest in Security Measures

Investing in security measures, such as alarm systems and surveillance cameras, can help protect your physical assets and reduce the risk of theft or vandalism. Many insurance companies offer discounts for businesses that take these proactive steps. It’s like investing in a high-tech bodyguard for your business.

Maintain Accurate Records

Thorough documentation of your business operations, risk management efforts, and any claims or incidents can be invaluable when it comes to securing affordable insurance coverage and handling potential disputes. It’s like a digital filing cabinet, keeping everything neat and tidy.

Getting Started with Cheap Insurance for Business

Ready to dive into the world of cheap insurance for your business? The first step is to start shopping around and getting quotes from multiple providers. Online platforms like Insureon make this process a breeze, allowing you to compare options from top-rated insurers with just a few clicks.

Remember to work closely with a licensed insurance agent who can provide personalized guidance and ensure that your coverage meets the specific needs of your business. They’ll be like your own personal insurance guru, helping you navigate the complexities and find the perfect policy.

When evaluating your insurance options, be sure to carefully review the policy details, including coverage limits, deductibles, and any exclusions. This will help you make an informed decision and find the right balance between protection and cost.

Investing in the right business insurance is not just a necessity – it’s a strategic move that can safeguard your startup and pave the way for long-term success. So, what are you waiting for? Let’s unlock affordable protection for your new business together!

FAQ

Q: What are the common exclusions in general liability insurance? A: General liability insurance policies typically exclude coverage for intentional or criminal acts, professional errors and omissions, and damage to your own business property. It’s important to review the exclusions in your policy to understand what is not covered.

Q: How do I know how much coverage I need? A: The amount of coverage you need depends on the size and nature of your business, the risks it faces, and any legal or contractual requirements. Work with your insurance agent to determine the appropriate coverage limits based on your specific needs.

Q: Can I get business insurance online? A: Absolutely! Many insurance providers now offer the ability to obtain business insurance quotes and purchase policies online. This can be a convenient and efficient way to compare options and secure coverage for your startup.

Q: What is a Certificate of Insurance (COI)? A: A Certificate of Insurance (COI) is a document that provides proof of your business’s insurance coverage. It includes details such as the types of insurance, policy limits, and the duration of coverage. This certificate is often required by clients or third parties to demonstrate that your business is properly insured.

Q: How often should I review my business insurance? A: It’s a good practice to review your business insurance coverage at least once a year, or whenever there are significant changes in your operations, such as adding new employees, expanding into new markets, or purchasing new equipment. Regular reviews help ensure that your coverage remains adequate and up-to-date.

Conclusion

Securing affordable business insurance is a crucial step in protecting your new venture. By understanding the essentials of business insurance, shopping around for the best deals, and implementing effective risk management strategies, you can find the right coverage at a price that fits your budget.

Don’t let financial risks hold you back from achieving your entrepreneurial dreams — start your journey to finding cheap insurance for your business today. With the right protection in place, you can focus on growing your company and reaching new heights, knowing that your business is safeguarded against the unexpected.

Remember, the cost of business insurance is a small investment compared to the potential financial consequences of not being insured. By taking the time to explore your options and tailor your policies to your specific needs, you can ensure that your business is protected without breaking the bank.

So, what are you waiting for? Let’s dive in and unlock the affordable protection your new business deserves!