As a senior residing in the Sunshine State, navigating the complex car insurance landscape can be a daunting task. With a myriad of factors influencing rates and an array of coverage options to consider, it’s crucial to approach the process with a strategic, data-driven mindset. This guide will provide insights into Florida’s car insurance market, including information on car insurance quotes for Florida, and equip you with the knowledge and tools to secure the most affordable and reliable coverage tailored to your unique needs as a senior driver.

Understanding the Car Insurance Landscape in Florida

Car in Florida

Car in Florida

Florida’s car insurance ecosystem is shaped by its unique no-fault system, which significantly impacts the coverage requirements and overall costs for senior drivers. Let’s explore the key elements of this system and how they can influence your insurance premiums.

Floridas No-Fault Approach

Florida teen driver

Florida teen driver

As a no-fault state, Florida requires all drivers to carry a minimum of $10,000 in Personal Injury Protection (PIP) and $10,000 in Property Damage Liability (PDL) insurance. Under this framework, accident victims must seek recovery for damages from their own insurers, regardless of who was at fault. While this system helps reduce the number of auto-related lawsuits, it also contributes to higher insurance premiums across the board.

Understanding Coverage Requirements

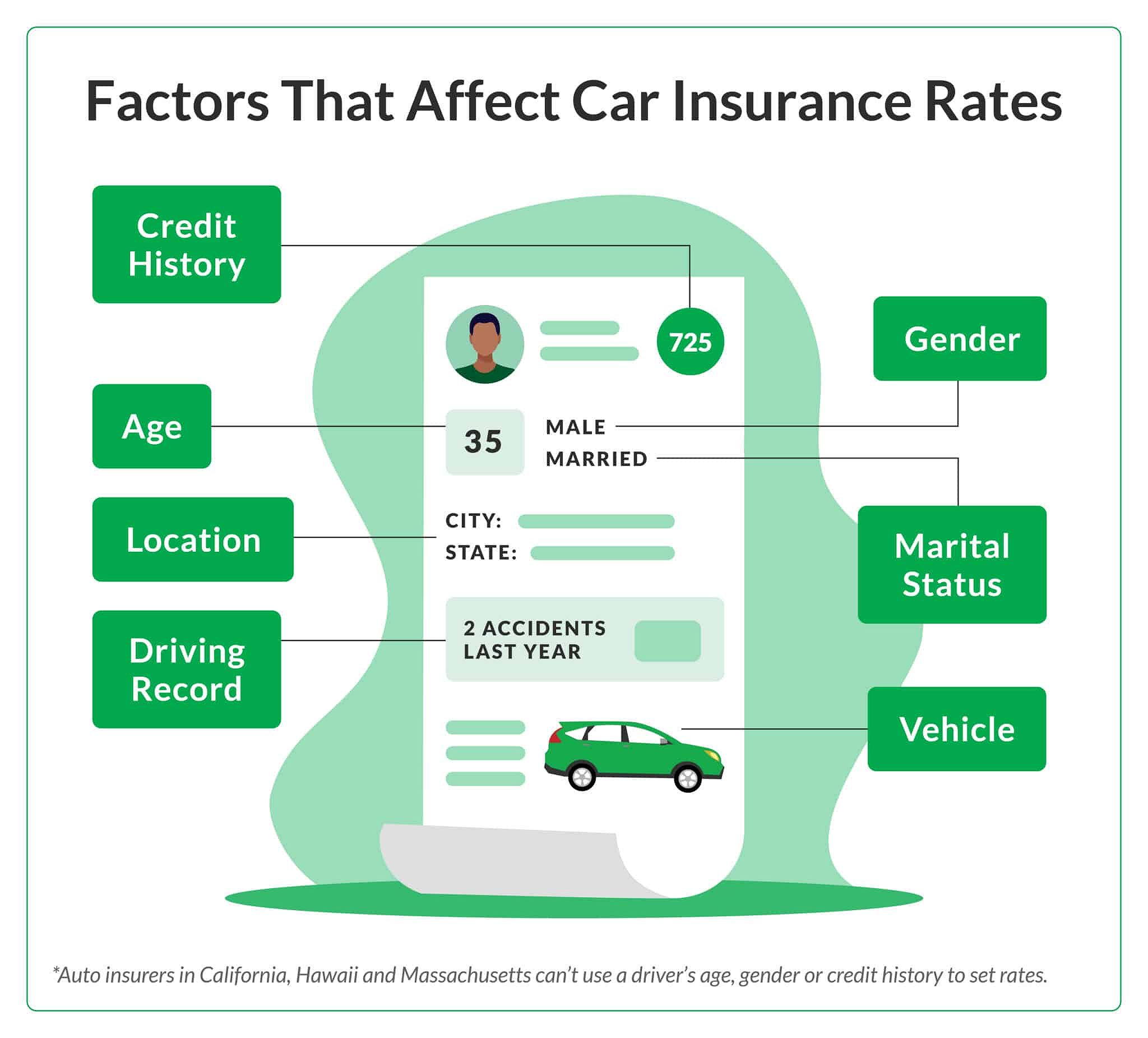

An image of a driving profile that shows details car insurance companies use to set premiums

An image of a driving profile that shows details car insurance companies use to set premiums

The minimum coverage requirements in Florida may seem sufficient, but they may not provide adequate protection, especially for seniors who have accumulated assets over their lifetimes. Opting for higher coverage limits can offer greater financial security in the event of a serious accident, shielding you from potentially devastating out-of-pocket expenses.

Factors Affecting Senior Rates

Several key factors can influence car insurance rates for seniors in Florida, including:

- Driving History: Maintaining a clean driving record with no accidents or violations is crucial, as it can lead to significantly lower premiums.

- Age: While seniors often benefit from age-based discounts, some insurers may perceive them as higher risk, which can result in higher costs.

- Vehicle Type: The make, model, and safety features of the vehicle can have a direct impact on the cost of coverage.

- Geographic Location: Living in high-risk areas with more accidents or crime can increase insurance rates.

By understanding these factors, you can make informed decisions and strategize effectively to find the best car insurance deals in Florida.

Strategies for Securing Affordable Car Insurance as a Florida Senior

To ensure you get the most bang for your buck, it’s crucial to leverage available discounts and compare quotes from multiple insurers. Let’s explore these tactics in detail.

Comparing Car Insurance Quotes for Florida from Multiple Providers

Car insurance quote

Car insurance quote

The car insurance market in Florida is highly competitive, with a wide range of providers, both large and small, vying for your business. By using online comparison tools or working with an independent agent, you can easily explore quotes from various insurers and find the most cost-effective coverage that meets your needs.

When comparing quotes, be sure to use the same coverage limits and deductibles across all providers to ensure an apples-to-apples comparison. This will help you identify the true differences in premiums and make an informed decision.

Leveraging Senior-Specific Discounts

Many car insurance companies offer discounts tailored specifically for senior drivers in Florida. These can include:

- Age-based Discounts: Insurers often provide discounts for drivers aged 55 and older, recognizing the experience and caution that comes with maturity.

- Safe Driver Discounts: Maintaining a clean driving record with no accidents or violations can earn you significant savings on your premiums.

- Multi-Policy Discounts: Bundling your auto insurance with homeowners or renters insurance can lead to additional cost savings.

- Defensive Driving Course Discounts: Completing a certified defensive driving course can help lower your insurance costs.

Be sure to inquire about all available discounts to maximize your savings and find the best car insurance deal for your budget.

Understanding Coverage Options

As you compare quotes, it’s essential to understand the various types of car insurance coverage and how they can impact your needs as a senior driver. Key coverage types to consider include:

- Liability Coverage: Protects you against financial losses if you cause an accident and are liable for damages.

- Collision Coverage: Covers the cost of repairing your vehicle in the event of a collision with another car or object.

- Comprehensive Coverage: Provides protection against non-collision-related damages, such as theft, vandalism, or natural disasters.

- Uninsured/Underinsured Motorist Coverage: Offers protection if you are involved in an accident with a driver who has insufficient or no insurance.

By carefully weighing the pros and cons of each coverage option, you can strike a balance between your protection needs and your budget, ensuring you have the right coverage to safeguard your financial well-being.

Maintaining Safe Driving Habits: The Key to Affordable Insurance

Adopting safe driving practices and staying informed about Florida’s driving laws can not only keep you and others on the road protected but also potentially lower your car insurance costs over time. Here are some crucial tips to consider:

- Regular Vehicle Maintenance: Ensuring your car is in good working order can help prevent accidents and costly repairs, which can impact your insurance premiums.

- Defensive Driving Techniques: Staying alert, maintaining a safe following distance, and avoiding distractions can significantly reduce your risk of being involved in an accident.

- Consideration of Driving Limitations: If you have any vision or cognitive issues that may affect your driving, discuss them with your doctor and family to determine if any driving restrictions are necessary.

- Staying Up-to-Date on Florida Driving Laws: Familiarize yourself with the state’s traffic regulations, especially those related to senior drivers, to ensure you are in compliance and avoid any violations.

- Exploring Alternative Transportation Options: When appropriate, consider using public transportation, ride-sharing, or carpooling to reduce your time behind the wheel and potentially lower your insurance costs.

By prioritizing safety and staying informed, you can not only protect yourself and others on the road but also potentially enjoy more affordable car insurance premiums in the long run.

FAQ

Q: What is the average car insurance rate for seniors in Florida? A: The average car insurance rate for seniors in Florida can vary significantly based on individual factors, such as driving history, vehicle type, and location. According to recent industry data, the average annual premium for senior drivers in Florida is around $1,500, although rates can range from $1,000 to $2,500 or more depending on the specific circumstances.

Q: Can I get car insurance if I have a medical condition that affects my driving? A: Yes, you can typically still obtain car insurance if you have a medical condition that impacts your driving. However, you may need to disclose the condition to the insurer, and your premiums may be higher due to the increased risk. It’s important to have an open discussion with your insurance provider about your specific situation.

Q: What should I do if my insurance company cancels my policy? A: If your car insurance provider cancels your policy, you should contact your state’s insurance regulator for assistance. They can help you explore options with other insurers and ensure you are treated fairly. Additionally, you may want to review the reasons provided for the policy cancellation and address any issues to improve your chances of securing coverage with another provider.

Q: Are there any special driving laws for seniors in Florida? A: While Florida does not have any age-specific driving restrictions, there are a few regulations that senior drivers should be aware of. For instance, drivers aged 80 and older must renew their licenses every 6 years instead of the standard 8-year renewal period. Additionally, seniors may be required to undergo vision tests more frequently to ensure their eyesight meets the necessary standards for safe driving.

Conclusion: Empowering Florida Seniors to Find the Best Car Insurance Deals

As a senior residing in the Sunshine State, navigating the car insurance landscape can be a complex and daunting task. However, by understanding the nuances of Florida’s no-fault system, leveraging available discounts, and comparing quotes from multiple providers, you can secure the coverage you need at a price that fits your budget.

Remember, maintaining safe driving habits and staying informed about the state’s driving laws can not only keep you and others on the road protected but also potentially lower your insurance costs over time. By taking a strategic, data-driven approach, you can find the best car insurance deals in Florida and enjoy the peace of mind that comes with being a responsible, well-informed senior driver.

Don’t wait any longer — start comparing car insurance quotes from reputable providers today and take the first step towards finding the coverage that works for you. Your financial security and driving confidence are worth the effort.