As an established dentist, I’ve had the privilege of building a thriving practice over the years. But as my ambitions grow, I’ve found myself in need of strategic financing to take my business to new heights. Whether it’s expanding my clinic, upgrading outdated equipment, or simply managing my finances more effectively, securing the right dental practice loan has become a crucial step in achieving my goals.

This comprehensive guide will share my insights and experiences to help fellow established dentists like yourself navigate the world of dental practice loans in 2024. We’ll explore the best dental practice loans available, understand the factors that influence loan terms, and learn how to position ourselves for the most favorable financing deals. By the end of this article, you’ll have the knowledge and confidence to make informed decisions that will propel your practice forward.

Demystifying Dental Practice Loans

Dental practice loans are a specialized form of small business financing designed to cater to the unique needs of dentists. These loans can be utilized for a variety of purposes, from starting a new practice to expanding an existing one, upgrading equipment, or simply improving the overall financial management of your business.

As an experienced dentist, I’ve had the opportunity to explore the different types of dental practice loans over the years. From government-backed SBA loans to traditional term loans, lines of credit, and even alternative financing options, each option comes with its own set of pros and cons. The key is to understand the nuances of each loan type and how they align with your specific financing requirements.

Navigating the Best Dental Practice Loans for Established Dentists

SBA Loans: The Government-Backed Advantage

SBA Loans: The Government-Backed Advantage

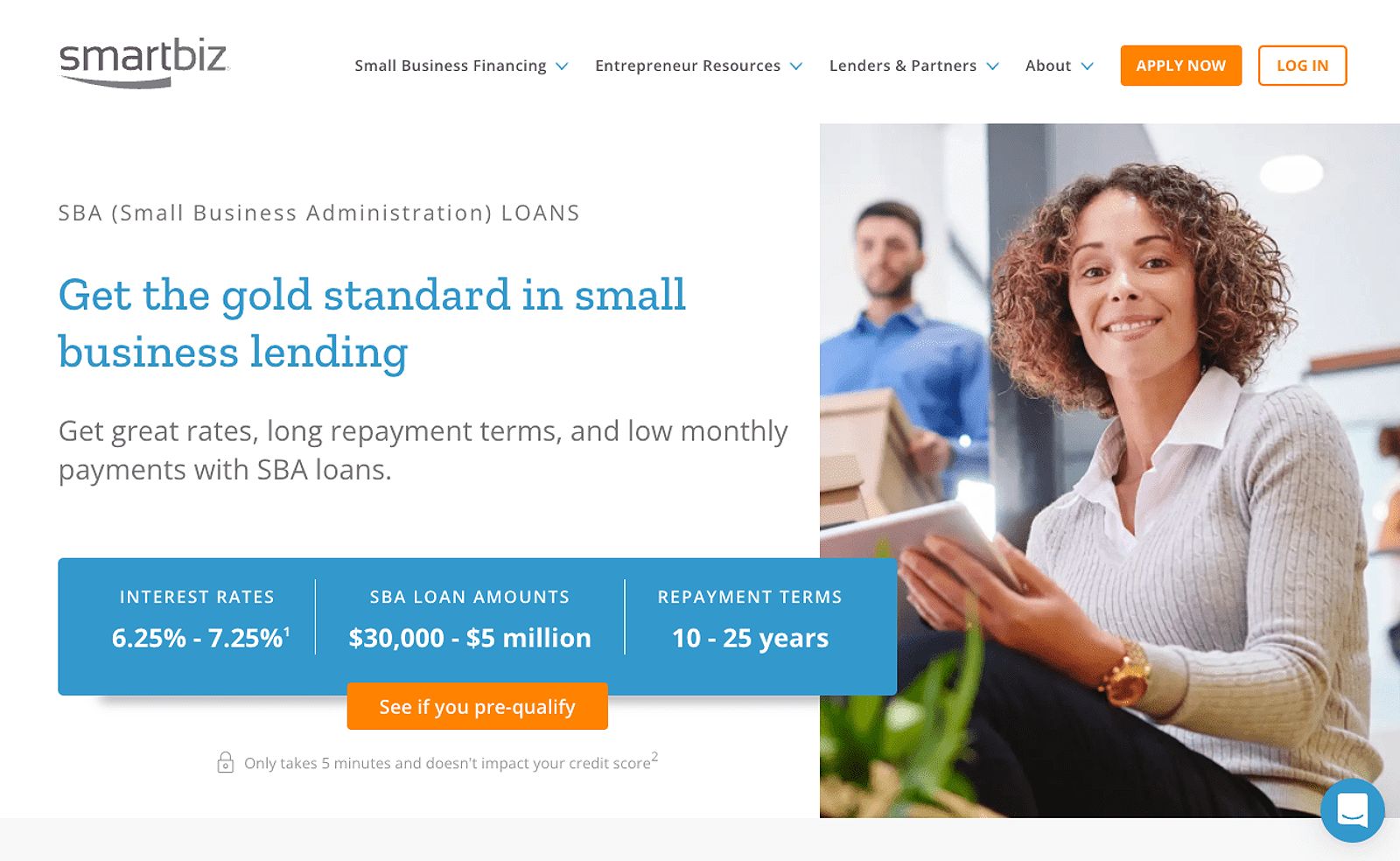

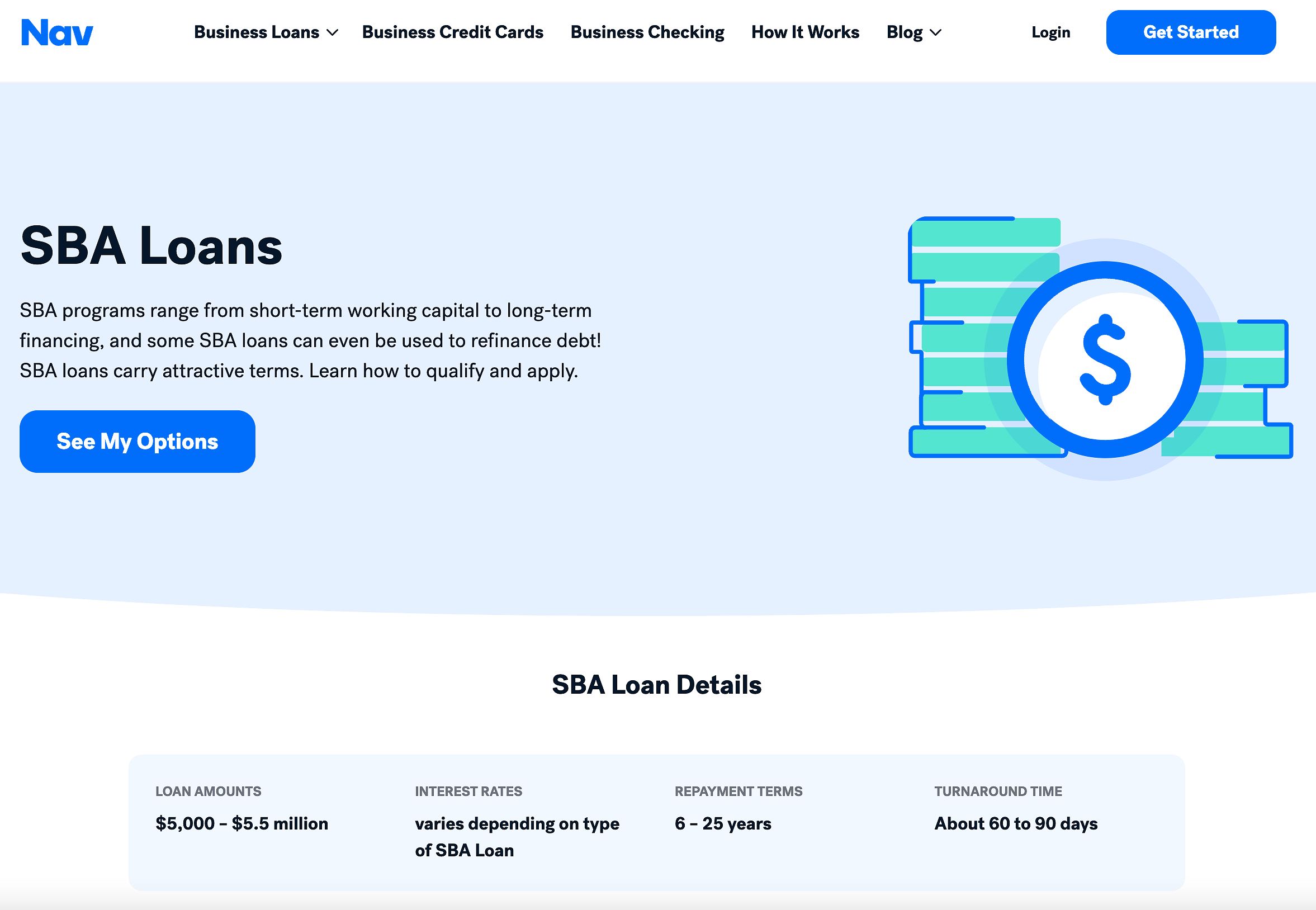

One of the loan options that has consistently stood out for me is the SBA (Small Business Administration) loan program. These government-backed loans offer a range of benefits that make them an attractive choice for established dentists like myself. With lower interest rates, longer repayment terms, and more flexible use of funds, SBA loans have been a game-changer in my practice’s growth strategy.

The SBA 7(a) loan program, in particular, has been a valuable tool in my arsenal. By working with an SBA-approved lender who specializes in dental practice financing, I’ve been able to navigate the application process with greater ease and secure the financing I need to expand my clinic, upgrade essential equipment, and optimize my overall financial management.

Term Loans: Predictable and Powerful

Term Loans: Predictable and Powerful

Term Loans: Predictable and Powerful

Another loan option that has served me well is the traditional term loan. These loans provide a lump sum of capital with fixed interest rates and predictable monthly payments, making them a reliable choice for managing cash flow and budgeting. I’ve found term loans to be particularly useful for practice expansions, equipment upgrades, and even debt consolidation, as they offer the flexibility to allocate the funds where they’re needed most.

The fixed interest rates and structured repayment schedules of term loans have allowed me to plan my finances with greater certainty, reducing the unpredictability that can sometimes come with other financing options. While the eligibility requirements may be a bit more stringent, the peace of mind and financial stability that term loans provide have made them an integral part of my practice’s growth strategy.

Lines of Credit: Navigating Cash Flow Fluctuations

Lines of Credit: Navigating Cash Flow Fluctuations

Lines of Credit: Navigating Cash Flow Fluctuations

Alongside term loans and SBA financing, I’ve also found business lines of credit to be a valuable tool in managing the ebb and flow of my practice’s cash flow. These flexible financing options provide me with access to a pool of funds that I can tap into as needed, paying interest only on the amount I borrow.

This has proven particularly useful during times of unexpected expenses or seasonal variations in revenue, allowing me to maintain a healthy cash flow and avoid disruptions to my operations. While lines of credit may have variable interest rates, which can make budgeting a bit more challenging, the benefits of their flexibility and on-demand access to funds have made them an indispensable part of my practice’s financial strategy.

Equipment Financing: Investing in the Tools of the Trade

Equipment Financing: Investing in the Tools of the Trade

Equipment Financing: Investing in the Tools of the Trade

As a dentist, investing in high-quality equipment is essential for providing the best care to my patients. That’s why I’ve turned to specialized dental equipment financing solutions to help me acquire the latest technology and tools. These financing options typically offer lower interest rates and more favorable terms compared to traditional business loans, allowing me to preserve my practice’s cash flow while upgrading my equipment.

By spreading the cost of new equipment over time, I’ve been able to make strategic investments that have not only improved the quality of care I provide but also enhanced the overall efficiency and competitiveness of my practice. The potential tax advantages associated with equipment financing have been an added bonus, further solidifying its value in my long-term financial planning.

Exploring Alternative Lenders

While traditional financing options have been the backbone of my practice’s growth, I’ve also explored alternative lenders as a way to address specific financing needs or accommodate unique circumstances. Online lenders, merchant cash advance providers, and other alternative financing sources have, at times, offered more flexible eligibility requirements and faster funding timelines, which can be beneficial for addressing urgent or time-sensitive needs.

However, it’s important to approach these alternative lenders with caution, as they may charge higher interest rates and have shorter repayment terms compared to traditional financing options. I’ve found that it’s crucial to carefully evaluate the terms and conditions of any alternative financing before committing, ensuring that it aligns with my practice’s long-term financial goals and doesn’t compromise my overall financial well-being.

Optimizing Your Credit and Loan Terms

As an established dentist, I know all too well the significant impact that credit scores and financial history can have on the terms and interest rates of a dental practice loan. That’s why I’ve made it a priority to continually monitor and improve my personal and business credit standing.

By staying on top of bill payments, maintaining low credit utilization, and addressing any discrepancies on my credit reports, I’ve been able to steadily enhance my credit profile over the years. This, in turn, has allowed me to negotiate better loan terms, secure lower interest rates, and ultimately, access more favorable financing arrangements that have fueled the growth and sustainability of my practice.

In addition to improving my credit score, I’ve also found that proactively shopping around and comparing offers from multiple lenders has been key to securing the best possible loan terms. By highlighting my track record of successful practice management, demonstrating the financial health and growth potential of my business, and leveraging the expertise of financial advisors or business loan brokers, I’ve been able to negotiate terms that align with my practice’s unique needs and long-term objectives.

Finding the Right Lender for Your Needs

As I’ve navigated the world of dental practice loans, I’ve come to realize the importance of aligning with the right lender. It’s not just about the loan terms and interest rates; it’s about finding a financing partner who truly understands the nuances of the dental industry and is committed to supporting the growth and success of my practice.

When evaluating potential lenders, I’ve focused on factors such as their industry experience, customer service, and reputation. I’ve also made it a point to thoroughly research the various loan products they offer, ensuring that the financing solution they provide is a perfect fit for my specific needs and goals.

By taking the time to find the right lender, I’ve been able to build a strong, long-term relationship that has proved invaluable in navigating the ever-evolving landscape of dental practice financing. Whether it’s seeking guidance on the latest industry trends, exploring new financing opportunities, or simply having a trusted advisor to bounce ideas off of, having the right lender in my corner has been a game-changer for my practice.

FAQ

Q: What documents do I need to apply for a dental practice loan? A: Lenders typically require a comprehensive financial package, including tax returns, financial statements, a detailed business plan, and credit reports. The specific documentation may vary depending on the lender and the type of loan, so it’s essential to be prepared with a thorough understanding of your practice’s financial health and growth prospects.

Q: How long does it take to get approved for a dental practice loan? A: The approval timeline can vary significantly, depending on the lender and the type of loan. SBA loans, for example, may have a longer processing time compared to some alternative financing options. On average, the approval process can range from a few days to a few weeks, so it’s important to factor in the timing when planning your financing needs.

Q: What are some common mistakes to avoid when applying for a dental practice loan? A: Some of the most common mistakes I’ve seen established dentists make include misrepresenting financial information, failing to shop around for the best rates, and not thoroughly understanding the loan terms and conditions before signing the agreement. It’s crucial to be transparent, do your research, and carefully review the fine print to ensure you’re making the best decision for your practice.

Conclusion

As an established dentist, navigating the world of dental practice loans can be a complex and often daunting task. However, by understanding the various financing options available, optimizing your credit profile, and aligning with the right lender, you can unlock the resources needed to take your practice to new heights.

Whether you’re looking to expand your clinic, upgrade your equipment, or simply improve your overall financial management, the insights and strategies I’ve shared in this guide can serve as a valuable roadmap. By leveraging the best dental practice loans in 2024, you’ll be empowered to make strategic, well-informed decisions that will propel your practice forward and ensure its long-term success.

So, take the time to explore the financing solutions that best fit your needs, and don’t be afraid to seek the guidance of financial professionals who can provide personalized advice and support. With the right loan in place, the future of your dental practice has never looked brighter.