As a proud Texan parent, I know the excitement and trepidation that comes with watching your teen take the wheel for the first time. Ensuring they have the right auto insurance coverage is crucial, and that’s why I’m here to guide you through the winding roads of Texas insurance policies. This article will equip you with the knowledge and tools to navigate the auto insurance landscape, find personalized auto insurance Texas quotes, and confidently protect your teen driver. Growing up in Texas, I remember the thrill of finally getting that learner’s permit at 15 and the sense of independence that came with it. Of course, my parents had a few rules to keep me safe, and that’s where understanding the state’s teen driving laws comes in handy.

Navigating the Texas Teen Driving Landscape

Learner’s Permit: The First Step Towards Freedom

In Texas, aspiring young drivers can apply for a learner’s permit at the ripe age of 15. This permit allows them to practice their driving skills, but only under the watchful eye of a licensed adult who is at least 21 years old. During this phase, there are some restrictions, such as limits on nighttime driving and the number of passengers allowed.

View of the city with cars driving on a highway

View of the city with cars driving on a highway

Provisional License: Expanding Horizons

Once your teen reaches the age of 16 and has held a learner’s permit for at least six months, they can upgrade to a provisional license. To obtain this, they’ll need to complete a driver’s education course, pass the required driving test, and meet other criteria. The provisional license comes with its own set of restrictions, but it’s an important step towards their driving independence.

Navigating Texas Auto Insurance: Protecting Your Teen Driver

Now, let’s dive into the nitty-gritty of auto insurance in the Lone Star State. As a Texan, I know that finding the right coverage for your teen can feel like navigating a maze, but I’m here to help you through it.

Texas highway driving

Texas highway driving

Minimum Liability Coverage: The Foundation

Texas law requires all drivers, including teens, to carry minimum liability insurance coverage. This coverage protects other drivers on the road in the event of an accident where your teen is at fault. The minimum liability coverage, often referred to as the “30/60/25” rule, means you’ll need:

- $30,000 in bodily injury liability per person

- $60,000 in bodily injury liability per accident

- $25,000 in property damage liability per accident

Enhancing Protection: Optional Coverages

While the minimum liability coverage is the legal requirement, you may want to consider adding some extra layers of protection for your teen driver. This could include:

- Collision coverage: Helps pay for repairs to your teen’s vehicle if they’re involved in an accident, regardless of fault.

- Comprehensive coverage: Covers damage to your teen’s car from events like theft, vandalism, or natural disasters.

- Uninsured/underinsured motorist coverage: Protects you if you’re in an accident with a driver who has insufficient or no insurance.

- Personal injury protection (PIP): Covers medical expenses and lost wages for you and your passengers, regardless of who is at fault.

Finding the Best Auto Insurance Texas Quotes for Your Teen

As a parent, I know how important it is to find the most affordable auto insurance coverage for your teen. Fortunately, there are strategies to help you navigate the process.

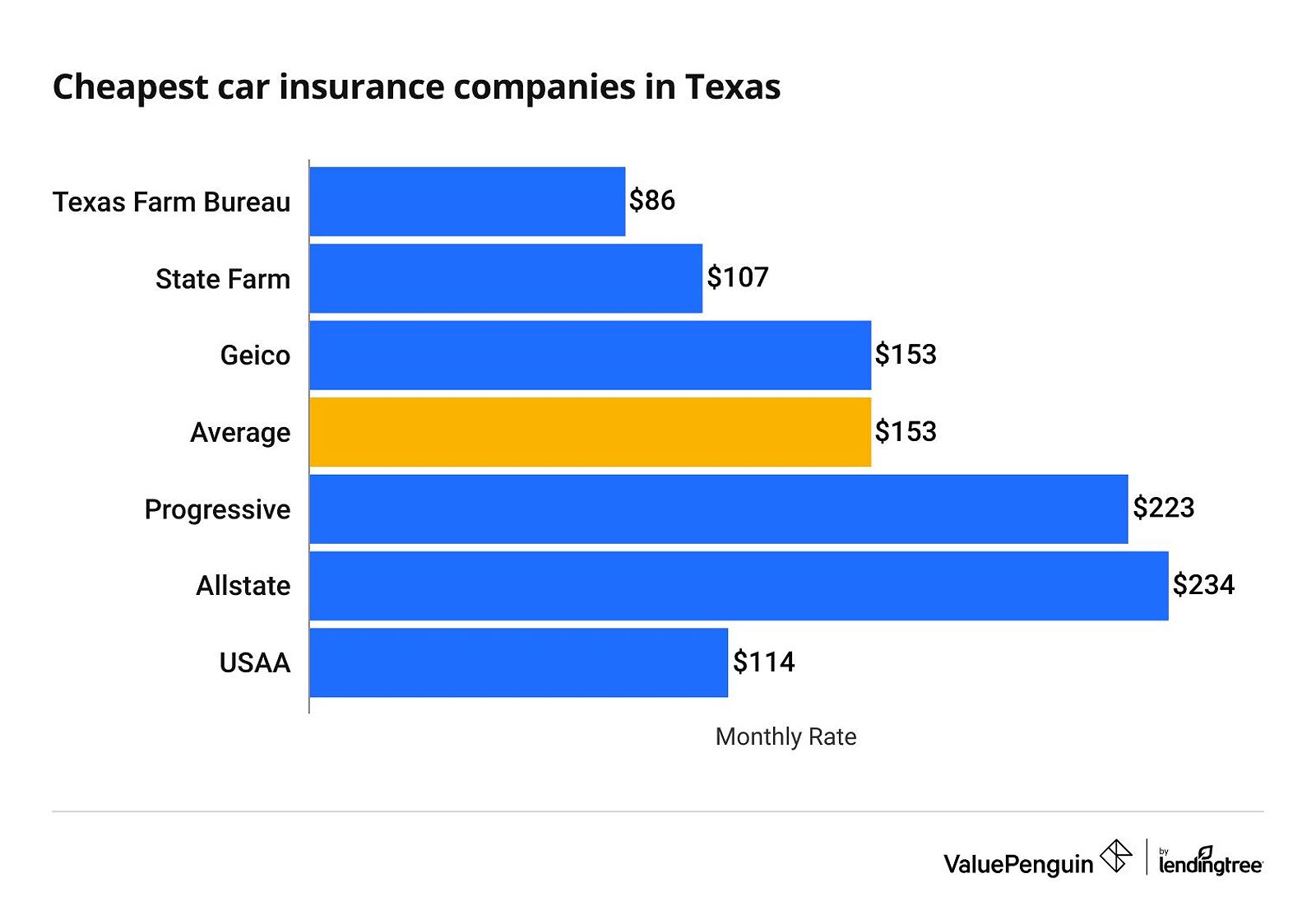

Cheapest car insurance companies in Texas

Cheapest car insurance companies in Texas

Factors That Influence Insurance Rates

Several key factors can impact the cost of auto insurance for teen drivers in Texas, including:

- Age: Younger drivers generally face higher rates due to their relative lack of experience.

- Driving history: A clean record can qualify your teen for discounts, while violations or accidents could lead to higher premiums.

- Vehicle type: The make, model, and age of the car your teen drives can affect the insurance costs.

- Location: Insurance rates can vary depending on the region and the frequency of accidents and claims in your area.

- Credit score: In Texas, insurers may consider your credit score when determining rates, as it can be an indicator of risk.

Unlocking Savings: Discounts for Texas Teen Drivers

Luckily, there are several ways for teen drivers in Texas to save on their auto insurance:

- Good student discount: Maintaining a strong grade point average (GPA) can earn your teen a nice discount.

- Defensive driving course: Completing an approved defensive driving course can potentially lower your teen’s rates.

- Multi-car discount: Insuring more than one vehicle with the same provider may result in savings.

- Safe driver discount: Keeping a clean driving record can make your teen eligible for a safe driver discount.

Comparing Quotes: The Key to Finding the Best Deal

To ensure you’re getting the most bang for your buck, it’s crucial to compare quotes from multiple insurance providers. Utilize online quote comparison tools to get personalized estimates and evaluate the coverage options that fit your needs and budget.

Full Coverage vs- Minimum Coverage: Striking the Right Balance

When it comes to auto insurance for your Texas teen, you’ll need to weigh the pros and cons of full coverage versus minimum coverage.

Texas desert cactus

Texas desert cactus

Full Coverage: Comprehensive Protection

Full coverage insurance typically includes collision and comprehensive coverage, which can provide more extensive protection for your teen’s vehicle. While it may come with a higher price tag, full coverage can help cover the cost of repairs or replacement if your teen is involved in an accident or their car is damaged by a non-accident event, such as theft or a natural disaster.

Minimum Coverage: Meeting the Legal Requirements

The minimum coverage required by Texas law, the “30/60/25” rule, only provides liability protection for other drivers in the event of an accident where your teen is at fault. This means it does not cover any damage to your teen’s own vehicle. Minimum coverage is generally more affordable, but it offers less comprehensive protection.

Tips for Texas Parents and Teen Drivers

As you navigate the auto insurance landscape for your teen driver in Texas, here are a few tips to keep in mind:

- Encourage your teen to practice safe driving habits and consider enrolling them in a defensive driving course.

- Maintain a clean driving record to qualify for discounts and keep insurance costs down.

- Explore options for reducing the cost of insurance, such as choosing a less expensive vehicle.

- Review your policy regularly and compare quotes from multiple insurers to ensure you’re getting the best coverage at the most competitive rate.

Remember, the right auto insurance coverage can provide peace of mind and financial protection for both you and your Texas teen driver.

FAQ

Q: What are the minimum age requirements for getting a driver’s license in Texas? A: The minimum age for a learner’s permit in Texas is 15, and the minimum age for a provisional license is 16.

Q: Is it required to have full coverage insurance for teen drivers in Texas? A: No, Texas only requires minimum liability coverage, but full coverage can provide more comprehensive protection for your teen’s vehicle.

Q: What are some common discounts available for teen drivers in Texas? A: Common discounts include good student discounts, defensive driving course discounts, multi-car discounts, and safe driver discounts.

Q: How can I find the cheapest auto insurance quotes for my teen driver in Texas? A: Compare quotes from multiple insurance companies using online quote tools to find the best coverage at the most affordable rate.

Conclusion

As a fellow Texan, I understand the importance of protecting your teen driver with the right auto insurance coverage. By navigating the state’s driving laws, understanding the insurance requirements, and exploring the available discounts, you can find personalized quotes that fit your budget and provide the coverage your family needs.

Remember, the journey to independence for your teen driver is an exciting one, and with the right auto insurance plan, you can help them navigate the roads of Texas with confidence. So, let’s get started on that quest for the perfect auto insurance coverage, shall we?