As a senior living in the vibrant state of Florida, finding affordable and suitable car insurance can be a daunting task. With the unique insurance landscape of the Sunshine State, it’s crucial to understand the state’s requirements and explore the options available to you. This article will guide you through the process of securing the best auto insurance quotes for Florida seniors, empowering you to save money while enjoying the freedom of the open road with confidence.

Understanding Floridas Car Insurance Requirements for Seniors

Navigating the Minimum Coverage Necessities

In Florida, all drivers, including seniors, are required to carry a minimum level of auto insurance. This includes Personal Injury Protection (PIP) coverage, which provides up to $10,000 in medical benefits, and $10,000 in Property Damage Liability coverage. These minimums are designed to protect you and other drivers on the road, but they may not be sufficient to cover the full extent of damages or medical expenses in the event of an accident.

While the state-required coverages are the starting point, you may want to consider adding additional protections to your policy. These can include collision and comprehensive coverage, which can help pay for repairs to your vehicle, as well as uninsured motorist coverage, which can protect you if you’re hit by a driver without insurance. Carefully weighing the benefits and drawbacks of these optional coverages can help you find the right balance between coverage and cost.

Car in Florida

Car in Florida

Understanding the Nuances of No-Fault Insurance in Florida

Florida is a no-fault state, which means that your own car insurance provider will cover your medical expenses and lost wages, regardless of who was at fault in an accident. This can provide some peace of mind, but it’s important to understand that you may still be able to pursue legal action against the at-fault driver in certain situations.

Maintaining Continuous Coverage: A Critical Consideration

It’s crucial to maintain continuous car insurance coverage in Florida, as the state can suspend your driver’s license and vehicle registration if you’re caught driving without the required minimum insurance. If your coverage is ever lapsed, you’ll need to provide proof of reinstatement and pay a fee to have your driving privileges restored. Staying on top of your insurance coverage is essential to avoid unnecessary headaches and legal complications.

Florida teen driver

Florida teen driver

Finding the Cheapest Auto Insurance Quotes for Florida Seniors

The Top Auto Insurance Companies for Seniors in the Sunshine State

When it comes to finding the most affordable auto insurance for seniors in Florida, several companies stand out as the front-runners. Based on our comprehensive research, the top five cheapest providers are:

- State Farm: Offering an average annual rate of $1,805 for full coverage and $650 for minimum coverage.

- Geico: Providing an average annual rate of $1,689 for full coverage and $682 for minimum coverage.

- Travelers: Averaging $1,979 per year for full coverage and $1,019 for minimum coverage.

- Progressive: Charging an average of $2,622 annually for full coverage and $1,606 for minimum coverage.

- Mercury: Offering an average annual rate of $2,478 for full coverage and $1,162 for minimum coverage.

These companies have a strong reputation for customer service, claims handling, and the availability of senior-specific discounts, making them attractive options for savvy senior drivers.

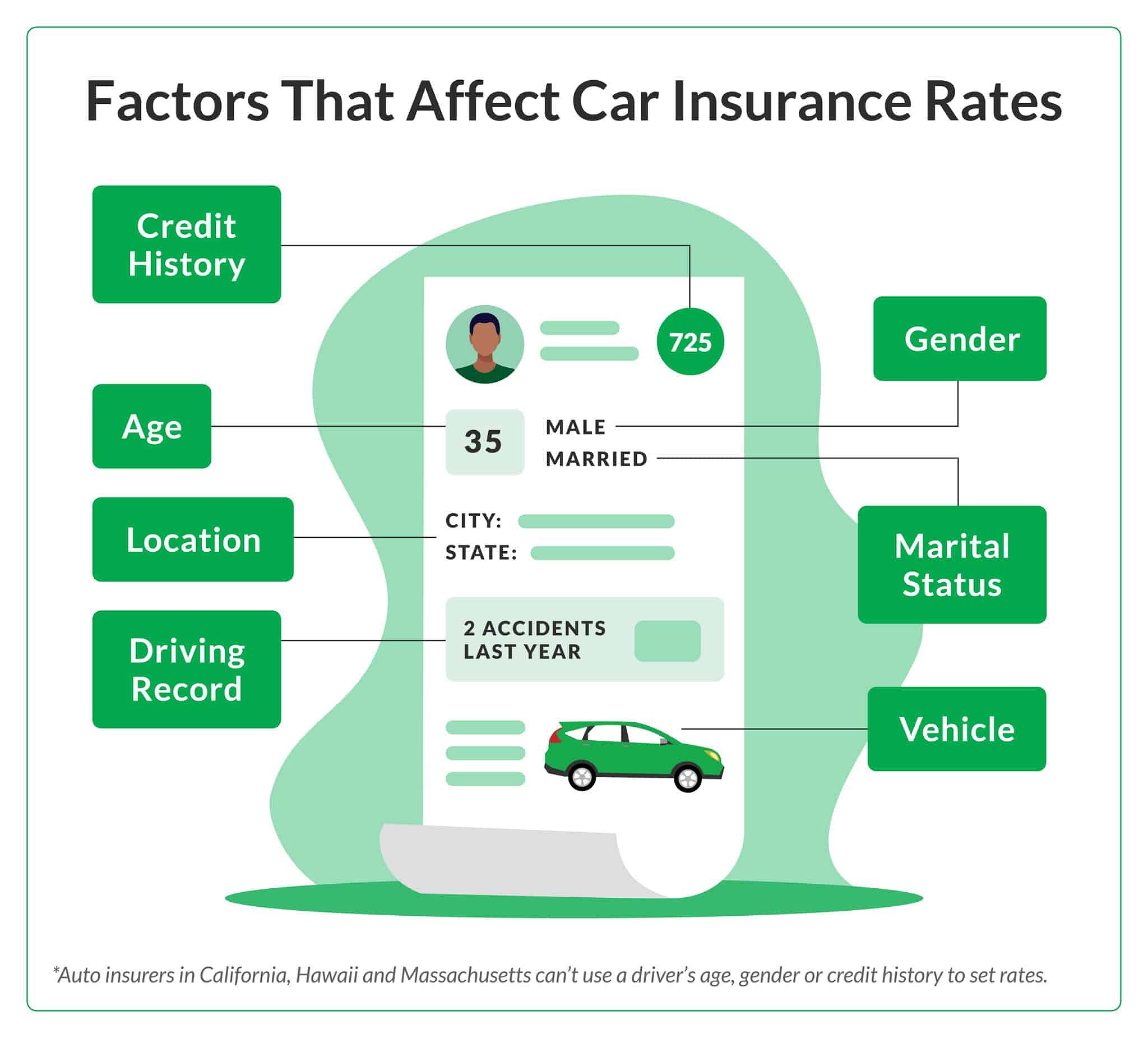

An image of a driving profile that shows details car insurance companies use to set premiums

An image of a driving profile that shows details car insurance companies use to set premiums

Strategies for Securing the Best Quotes

To ensure you’re getting the most competitive rates, it’s essential to compare quotes from multiple insurers. When requesting quotes, be sure to provide the same coverage limits, deductibles, and vehicle information for each provider. This will give you a clear and accurate comparison of the options available to you.

Additionally, don’t hesitate to negotiate with insurers or ask about any available discounts. Many companies offer savings for safe driving, good credit, and even membership in certain organizations. By proactively exploring these opportunities, you can maximize your savings and find the coverage that best suits your needs.

Senior-Specific Discounts and Savings Opportunities

Unlocking the Power of Florida’s Senior Driver Discounts

Florida offers several auto insurance discounts specifically catered to senior drivers. These can include:

- Safe Driver Discount: If you maintain a clean driving record, you may be eligible for a discount of up to 25%.

- Good Student Discount: If you have a grandchild or dependent who maintains a good academic standing, you could qualify for a discount.

- Multi-Policy Discount: Bundling your auto insurance with other policies, such as homeowners or renters insurance, can result in significant savings.

On average, seniors in Florida can save between 5% and 25% on their auto insurance premiums by taking advantage of these discounts. By proactively exploring and claiming these opportunities, you can make a meaningful dent in your insurance costs.

Additional Strategies to Optimize Your Savings

In addition to senior-specific discounts, there are other ways you can lower your insurance costs. Consider increasing your deductible, which can result in a lower premium. You can also explore ways to improve your driving record, such as completing a defensive driving course, which may also lead to savings.

By combining these strategies with the senior-focused discounts, you can create a comprehensive plan to secure the best possible auto insurance rates in Florida.

Staying Safe on the Road: Tips for Senior Drivers

As a senior driver in the Sunshine State, maintaining safe driving habits is paramount not only for your own well-being but also for the safety of others on the road. Regular vehicle maintenance, being aware of common driving hazards, and adjusting your driving style as needed can all contribute to a safer driving experience.

Consider taking a defensive driving course specifically designed for seniors, which can help you refresh your skills, learn new techniques, and potentially earn a discount on your insurance premiums. These courses can cover topics such as managing distractions, adapting to changing road conditions, and anticipating the actions of other drivers.

Additionally, it’s important to be mindful of your physical and cognitive abilities as you age. If you notice any changes in your vision, reaction time, or decision-making skills, don’t hesitate to consult with your healthcare provider. They can help you determine if it’s time to make adjustments to your driving habits or consider alternative transportation options.

Remember, staying informed, proactive, and adaptable as a senior driver in Florida can help you navigate the roads with confidence and ensure you have the coverage you need.

Cheerful young lady working on her computer to find cheap car insurance with Geico

Cheerful young lady working on her computer to find cheap car insurance with Geico

Comparing Car Insurance Providers in Florida

When it comes to finding the best car insurance for seniors in Florida, it’s crucial to compare quotes from multiple providers to ensure you’re getting the most competitive rates. While the top five companies we highlighted earlier are a great starting point, it’s important to consider your individual needs and circumstances when evaluating your options.

For example, if you have a clean driving record and good credit, you may be able to find even lower rates with certain insurers. Conversely, if you have a less-than-perfect driving history or live in an area with higher accident rates, some providers may offer more favorable terms or specialized coverage options.

To make the comparison process easier, we’ve put together a table that outlines the key factors to consider when evaluating car insurance providers in Florida:

| Factor | Importance | Top Providers |

|---|---|---|

| Average Rates | High | State Farm, Geico, Travelers |

| Discounts | High | State Farm, Geico, Travelers |

| Customer Satisfaction | High | Travelers, State Farm, Geico |

| Financial Strength | Medium | State Farm, Travelers, Geico |

| Coverage Options | Medium | Geico, State Farm, Travelers |

By taking the time to carefully assess each provider’s offerings, you can find the best balance of coverage, cost, and customer service to meet your needs as a senior driver in Florida.

FAQ

Q: Do I need to take a driving test if I’m a senior in Florida? A: Florida does not have a mandatory driving test for seniors, but it’s a good idea to get a check-up from your doctor to ensure you’re still fit to drive.

Q: How can I improve my driving record to lower my insurance rates? A: Focus on safe driving practices, avoid traffic violations, and consider taking a defensive driving course to reduce points on your record.

Q: What should I do if I’m involved in an accident? A: Follow the steps outlined in your insurance policy, contact your insurance company immediately, and document the accident thoroughly.

Conclusion

Finding affordable and suitable auto insurance as a senior in Florida can be a challenge, but with the right strategies, you can secure the coverage you need while saving money. By understanding the state’s requirements, exploring the top insurance providers, and taking advantage of senior-specific discounts, you can drive with confidence and peace of mind.

Remember to regularly review your policy, compare quotes, and stay vigilant on the road to ensure you’re getting the best value for your auto insurance. With the right approach, you can enjoy the freedom of the open road while keeping your costs in check.

As you navigate the car insurance landscape in Florida, don’t hesitate to reach out to local agents or industry experts for personalized guidance. They can help you navigate the unique nuances of the state’s insurance laws and ensure you have the coverage that best fits your needs as a senior driver.

With the right information and a proactive approach, you can find the perfect auto insurance solution that provides the protection you need while keeping your costs in check. Drive safe, and keep exploring the beautiful Sunshine State with the confidence that comes from having the right car insurance coverage.