Ah, the thrill of becoming a homeowner – it’s a dream come true! But as an eager new homeowner myself, I quickly realized that securing the right insurance coverage was crucial to protecting my most significant investment. That’s where auto homeowners insurance quotes come into play, helping me find the perfect balance between comprehensive protection and cost-effective premiums.

Let me share my personal journey with you and provide the tips and insights I’ve learned along the way. Whether you’re a first-time homebuyer or a seasoned property owner, this guide will arm you with the knowledge and strategies to make informed decisions about your insurance needs.

The Importance of Homeowners Insurance: Your Financial Safeguard

As a recent homeowner, I can attest to the immense sense of accomplishment and pride that comes with owning your own property. But with this achievement comes new responsibilities – one of the most important being ensuring your home and belongings are adequately protected.

Homeowners insurance has been my financial safeguard, providing the coverage I need in the face of unexpected disasters. Imagine if a severe storm had damaged my roof or a burst pipe caused extensive water damage – without insurance, the costs of repairing or rebuilding my home could have been overwhelming. And let’s not forget the liability coverage that protects me in case someone is injured on my property.

While homeowners insurance may be required by my mortgage lender, I’ve come to see it as a wise investment to safeguard my greatest asset – my home. By understanding the various coverage options and their significance, I can rest easy knowing that my financial future is secure, even in the face of life’s curveballs.

Navigating Auto Homeowners Insurance Quotes: Unlocking the Key Terms

When I first started exploring auto homeowners insurance quotes, I’ll admit it felt a bit daunting. But by breaking down the key terms and coverage types, I was able to navigate the process with confidence.

Let’s start with the premium – the amount I pay for my insurance policy, either monthly or annually. Then there’s the deductible, which is the amount I need to pay out-of-pocket before my coverage kicks in. And of course, the coverage limits, which determine the maximum amount my insurer will pay for a covered loss. It’s crucial to choose limits that align with the value of my home and possessions.

My homeowners insurance policy includes several essential coverage types:

- Dwelling coverage: This protects the physical structure of my home, including the walls, roof, and foundation, in the event of a covered loss.

Property damage

Property damage

- Personal property coverage: This covers the replacement or repair of my personal belongings, such as furniture, appliances, and electronics, if they are damaged or stolen.

Personal property

Personal property

- Liability coverage: This safeguards me from financial responsibility if someone is injured on my property or if I’m found liable for damaging someone else’s property.

Personal liability

Personal liability

- Loss of use coverage: This can help cover my additional living expenses, like hotel stays or temporary housing, if my home becomes uninhabitable due to a covered loss.

Living expenses

Living expenses

And the best part? I was able to bundle my auto and homeowners policies, often resulting in significant savings thanks to the discounts insurers offer for customers who insure multiple products with them.

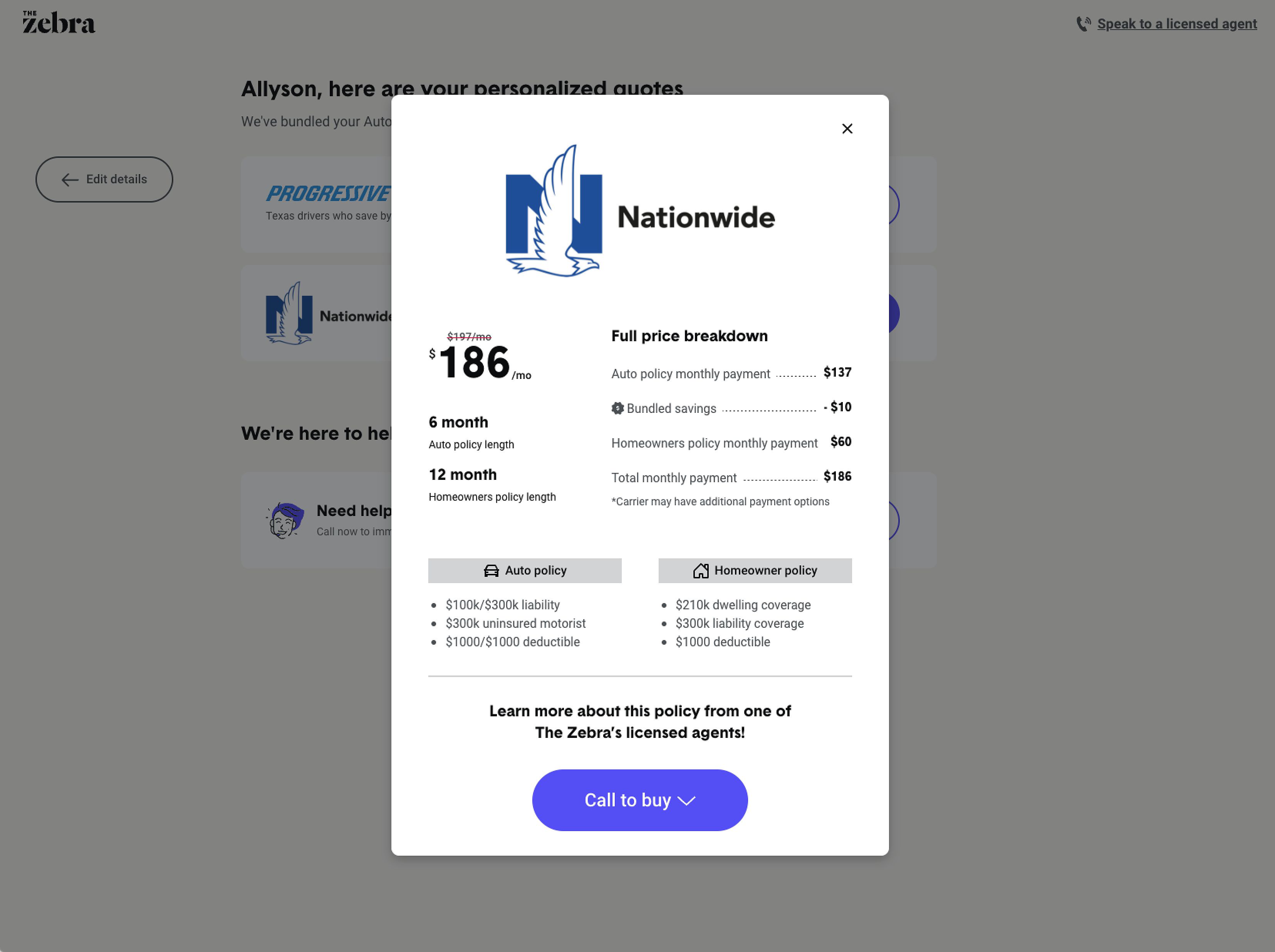

Screenshot of what you comparing quotes for home and auto insurance through The Zebra

Screenshot of what you comparing quotes for home and auto insurance through The Zebra

Strategies for Securing the Best Auto Homeowners Insurance Quotes

As an eager homeowner, I knew I needed to do my due diligence to find the most comprehensive coverage at the best possible price. That’s why I set out to compare auto homeowners insurance quotes from multiple providers.

One of the first things I looked for was bundling discounts. By combining my auto and homeowners policies with the same insurer, I was able to save a substantial amount, often ranging from 5% to 20% or more. It was a no-brainer for me, and I’m confident you’ll find similar savings.

Next, I considered the safety and security features of my home. Many insurers offer discounts for homes equipped with security systems, smoke detectors, and other safety measures that can help mitigate the risk of claims. It’s a win-win – I get to enjoy the peace of mind of a secure home while also saving on my premiums.

When it came to selecting my deductible levels, I carefully weighed my options. Choosing a higher deductible can lower my monthly or annual premiums, but I made sure I had the financial means to cover the deductible if I ever needed to file a claim.

And perhaps most importantly, I ensured that my coverage limits were adequate to replace my home and personal belongings in the event of a total loss. Underinsuring can leave you vulnerable to significant out-of-pocket expenses, so I took the time to get it right.

By shopping around and taking advantage of available discounts, I was able to find the best auto homeowners insurance quotes that provide the protection I need at a price that fits my budget. And I’m confident you can do the same!

Factors Shaping Auto Homeowners Insurance Quotes: Understanding the Landscape

As I delved deeper into the world of auto homeowners insurance quotes, I quickly learned that there are several factors that can influence the cost of my coverage. Understanding these elements has been key to making informed decisions about my insurance needs.

Location, for instance, plays a significant role. Where my home is situated can have a substantial impact on my premiums. Factors like crime rates, natural disaster risks, and proximity to fire hydrants can all affect the cost of my coverage.

The value of my home is another crucial factor. The more it would cost to rebuild my property, the higher my dwelling coverage premiums are likely to be. Insurers use the estimated replacement cost to determine the appropriate coverage limits.

Interestingly, my credit score has also been taken into account by some insurers. Research has shown a correlation between credit history and the likelihood of filing insurance claims, so this is something I’ve kept in mind when comparing quotes.

And of course, the coverage levels I choose can also impact the cost. Opting for higher limits, such as increased liability protection or more comprehensive personal property coverage, can result in higher premiums. But for me, it’s been worth it to have that extra layer of protection.

By understanding these factors, I’ve been able to make informed decisions about the coverage levels that best fit my needs and budget. It’s all about finding the right balance between comprehensive protection and cost-effective premiums.

Saving on Auto Homeowners Insurance Quotes: My Insider Tips

As a new homeowner, I’ve been on the hunt for ways to save on my auto homeowners insurance quotes without compromising the coverage I need. And I’m excited to share some of the insider tips I’ve discovered along the way.

One of the first things I did was to focus on improving the security of my home. By installing a security system, smoke detectors, and other safety features, I was able to qualify for discounts from my insurer. It’s a win-win, as I not only save on my premiums but also enjoy the added peace of mind of a well-protected home.

Maintaining my home has also been a key strategy in keeping my insurance costs down. By regularly addressing any necessary repairs and staying on top of routine maintenance, I’ve been able to prevent costly claims, which can, in turn, lower my premiums.

Staying on top of the insurance market has been another crucial tactic. I make it a point to review my auto homeowners insurance quotes annually, as my needs and the market may change over time. This ensures I’m always getting the best deal.

And when it comes to my deductible, I’ve found that choosing a slightly higher amount can significantly reduce my monthly or annual premiums. Of course, I’ve made sure I have the financial means to cover the deductible if I ever need to file a claim.

But perhaps my biggest money-saving secret has been the power of bundling. By combining my auto and homeowners insurance policies with the same insurer, I’ve been able to unlock substantial savings through multi-policy discounts. It’s a strategy I highly recommend to fellow homeowners.

By implementing these strategies, I’ve been able to maximize my savings on auto homeowners insurance quotes without compromising the coverage I need to protect my home and assets. And I’m confident you can do the same!

FAQ

Q: What is the difference between homeowners insurance and renters insurance? A: The primary difference is that homeowners insurance covers the structure of your home, as well as your personal belongings and liability, while renters insurance only protects your personal property and liability as a tenant. As a homeowner, it’s essential to have the right coverage to safeguard your biggest investment.

Q: How do I know how much coverage I need? A: When determining your coverage needs, consider the replacement cost of your home, the value of your personal belongings, and the level of liability protection you require. Your insurer can help you assess the appropriate coverage limits to ensure you have the protection you need without overpaying.

Q: What are some common exclusions in homeowners insurance policies? A: Common exclusions can include damage from earthquakes, floods, and wear and tear. It’s crucial to review your policy carefully to understand what is and is not covered. This way, you can identify any gaps in your coverage and make informed decisions about additional protection you may need.

Q: What happens if I need to file a claim? A: If you experience a covered loss, you’ll need to contact your insurer to file a claim. They will guide you through the process, which may involve providing documentation, getting estimates for repairs, and following their claims procedures. Remember, having a good understanding of your policy and coverage can make this process much smoother.

Conclusion: Unlocking the Power of Auto Homeowners Insurance Quotes

As a new homeowner, securing the right auto homeowners insurance quotes has been a crucial step in protecting my most significant investment. By understanding the importance of homeowners insurance, familiarizing myself with the key coverage types, and exploring strategies to save on my premiums, I’ve been able to find the comprehensive protection I need at a price that fits my budget.

The journey of homeownership is an exciting one, and with the right insurance coverage in place, I can focus on creating cherished memories in my new abode, confident that my financial future is safeguarded. I hope that by sharing my personal experiences and insights, I’ve been able to empower you to make informed decisions about your own insurance needs.

So, what are you waiting for? It’s time to start exploring those auto homeowners insurance quotes and unlock the financial security you deserve. Let’s embark on this journey together and ensure your home and assets are protected, no matter what life throws our way.