In the heart of the Lone Star State, where the roads are expansive and the spirit of independence runs deep, the journey of insuring your teen driver can feel like uncharted territory. As a parent, you want to ensure your young motorist is protected without breaking the bank. This comprehensive guide will equip you with the knowledge and strategies to find the best auto insurance quotes in Texas, tailored specifically for your teen driver.

Understanding the Texas Teen Driving Landscape

Texas has a unique set of laws and regulations governing teen driving, and navigating this landscape is crucial for securing the right auto insurance coverage. Let’s dive into the details.

Learners Permits and Provisional Licenses

In Texas, teens can obtain a learner’s permit at the age of 15, allowing them to practice driving under the supervision of a licensed adult aged 21 or older. After holding the learner’s permit for at least six months and completing the required driver’s education course, they can then apply for a provisional license at 16. This provisional license comes with certain restrictions, such as limits on nighttime driving and the number of passengers allowed.

The transition from a learner’s permit to a provisional license can significantly impact your teen’s auto insurance rates. Insurance companies often view learner’s permit holders as higher-risk, resulting in higher premiums. However, once your teen obtains their provisional license and demonstrates responsible driving behaviors, you may see a decrease in your insurance costs.

The Impact Texas Teen Driver (ITTD) Course

Another important factor in Texas teen driving laws is the Impact Texas Teen Driver (ITTD) course. This defensive driving program is designed to educate young drivers on the importance of safe and responsible driving practices. Completing the ITTD course is a requirement for obtaining a provisional license in Texas.

By ensuring your teen completes the ITTD course, you may be able to take advantage of insurance discounts offered by many providers. These discounts recognize the valuable knowledge and skills gained through the program, which can translate into lower accident risks and, ultimately, more affordable auto insurance premiums.

Factors Influencing Auto Insurance Quotes in Texas for Teen Drivers

Beyond the legal landscape, several other factors can significantly impact the auto insurance quotes you receive for your teen driver in Texas. Understanding these elements can help you navigate the insurance market with confidence.

Driving History

Your teen’s driving history plays a crucial role in determining their auto insurance rates. A clean driving record, free of accidents, violations, or citations, can help secure more favorable quotes. Conversely, any incidents on their record, such as speeding tickets or at-fault collisions, are likely to result in higher premiums.

To keep your teen’s insurance costs low, encourage them to maintain a safe and responsible driving behavior. Enrolling them in defensive driving courses or implementing a family policy of safe driving practices can further demonstrate their commitment to road safety, potentially leading to additional discounts.

Vehicle Selection

The type of vehicle your teen drives can also impact the auto insurance quotes you receive. Generally, high-performance or luxury vehicles tend to have higher insurance rates compared to more affordable, safer models. When selecting a car for your teen, consider options with advanced safety features, such as forward collision warning systems or electronic stability control, as they may qualify for discounts.

Additionally, older vehicles may be less expensive to insure, as their replacement costs are lower. However, it’s important to balance the cost savings with the vehicle’s overall safety and reliability, as your teen’s well-being should be the top priority.

Location and Driving Habits

Where your teen lives and their driving habits can also influence auto insurance rates in Texas. Teens living in urban areas with higher population densities and accident rates may face higher premiums compared to those in rural or suburban regions. Additionally, factors like the distance your teen drives and the frequency of their commutes can impact the risk assessment made by insurance providers.

To mitigate the effect of location and driving habits, consider encouraging your teen to limit unnecessary driving, avoid high-traffic areas, and practice defensive driving techniques. Some insurers may even offer discounts for low mileage or the installation of telematics devices that monitor driving behavior.

Securing the Best Auto Insurance Quotes for Your Texas Teen

Navigating the world of auto insurance can feel overwhelming, but with the right strategies, you can find the most affordable coverage that meets your teen’s needs. Let’s explore the steps you can take to secure the best auto insurance quotes in Texas.

Comparing Quotes from Multiple Providers

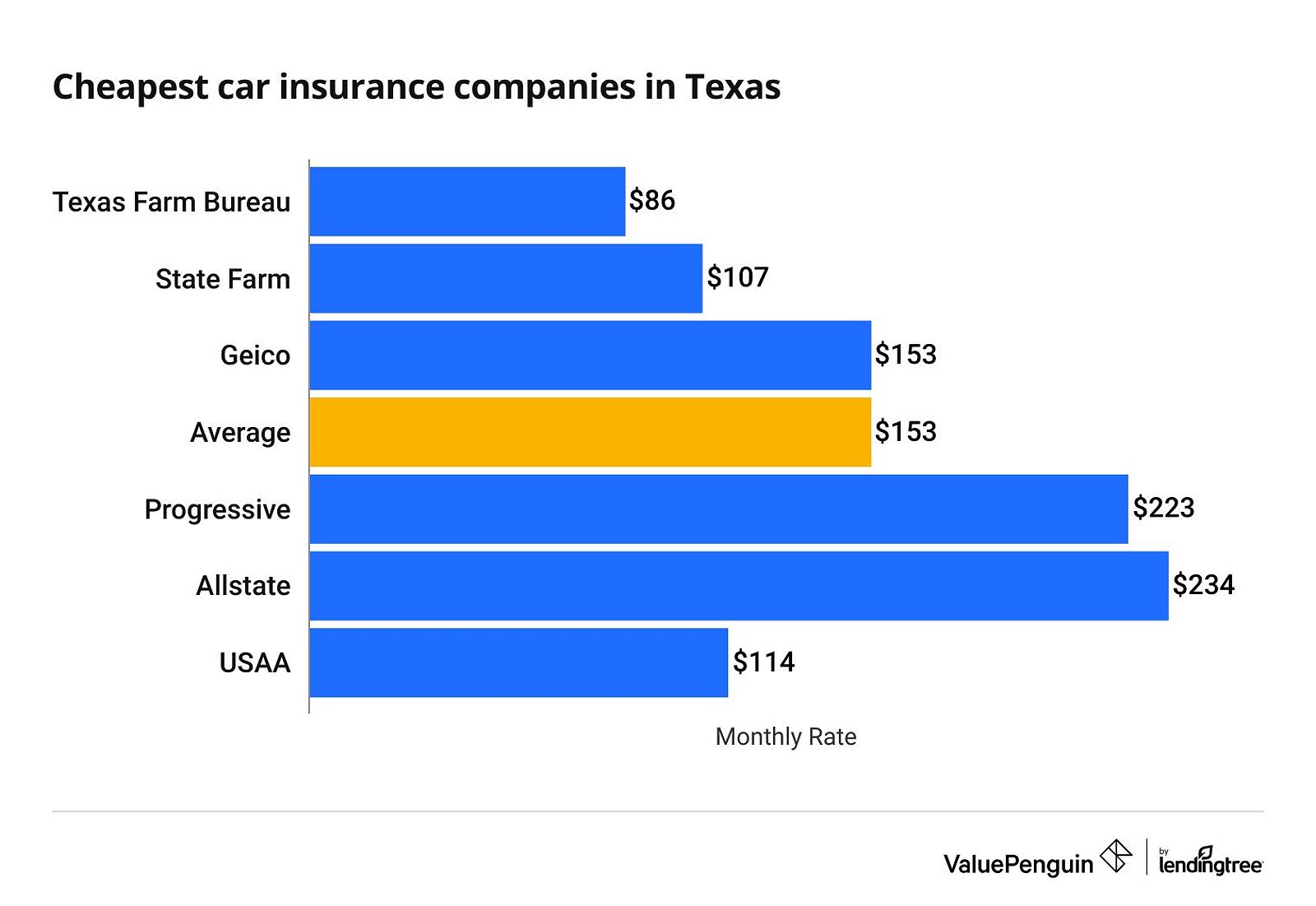

When it comes to finding the best auto insurance quotes for your teen driver in Texas, it’s essential to shop around and compare offerings from multiple providers. Utilize online comparison tools or reach out to local insurance agents to get a comprehensive understanding of the coverage options and rates available.

Remember, the “cheapest” option may not always be the best choice. Consider factors like customer service, claims handling, and the provider’s financial stability to ensure you’re getting a reliable policy that will protect your teen in the event of an accident.

Exploring Available Discounts

Insurance companies in Texas often offer a variety of discounts that can help reduce the cost of your teen’s auto insurance. These may include good student discounts, safe driver discounts, multi-car discounts, and defensive driving course discounts. Be sure to inquire about all potential savings opportunities and provide the necessary documentation to take advantage of them.

By actively seeking out and applying these discounts, you can significantly lower the financial burden of insuring your teen driver, allowing you to focus on their safety and development on the road.

Negotiating Rates and Coverage

Don’t be afraid to negotiate with insurance providers to secure the best possible rates and coverage for your teen. Highlight your teen’s safe driving record, their completion of defensive driving courses, and any other factors that demonstrate their responsible behavior behind the wheel. Additionally, consider adjusting coverage levels or exploring alternative options, such as raising deductibles, to find the right balance between protection and affordability.

Effective communication and a willingness to explore different scenarios can help you navigate the complexities of auto insurance and ensure your teen driver is appropriately covered without overpaying.

Promoting Safe Driving Habits

As a parent, your role in shaping your teen’s driving habits cannot be overstated. By fostering a culture of responsibility and accountability, you can not only keep your teen safe on the roads but also potentially secure more affordable auto insurance premiums in the long run.

Setting Clear Expectations and Rules

Establish clear expectations and rules for your teen driver, such as curfews, passenger restrictions, and the importance of avoiding distractions, such as phone usage, while driving. Consistently enforcing these guidelines not only promotes safety but can also contribute to lower insurance premiums.

By creating a supportive and structured environment, you can help your teen develop the necessary driving skills and habits to become a confident and responsible motorist.

Encouraging Responsible Driving Practices

In addition to setting rules, actively encourage your teen to practice responsible driving techniques. Emphasize the importance of defensive driving, maintaining a safe following distance, and remaining alert to potential hazards on the road. Encourage them to participate in additional driver education programs or defensive driving courses, as these can further enhance their skills and potentially earn them insurance discounts.

By modeling and reinforcing these responsible driving practices, you can instill valuable habits that will not only keep your teen safe but also contribute to more affordable auto insurance rates in the long run.

Monitoring Driving Behavior and Setting Limits

Closely monitoring your teen’s driving behavior and setting realistic limits can help mitigate risks and maintain affordable auto insurance premiums. Consider using GPS tracking devices or telematics technology to gain insights into your teen’s driving habits, such as speeding, harsh braking, and distracted driving. Use this information to have open discussions and adjust driving privileges accordingly.

Remember, a proactive approach to managing your teen’s driving experience can have a significant impact on their safety and the long-term cost of their auto insurance in Texas.

FAQ

Q: What are the minimum car insurance requirements for teen drivers in Texas? A: In Texas, all drivers, including teens, are required to have liability insurance with minimum limits of $30,000 per person for bodily injury, $60,000 per accident for bodily injury, and $25,000 per accident for property damage.

Q: Can I get a discount on my teen’s car insurance if they take a driver’s education course? A: Yes, many insurance companies in Texas offer discounts to teen drivers who complete a driver’s education course, such as the Impact Texas Teen Driver (ITTD) program. These discounts recognize the additional training and safe driving skills acquired through the course.

Conclusion

As your teen embarks on their driving journey in Texas, finding the right auto insurance coverage can seem like a daunting task. However, by understanding the unique legal landscape, exploring the factors that influence insurance rates, and proactively promoting safe driving habits, you can navigate this process with confidence and secure the best possible coverage for your young motorist.

Remember, the key to finding the most affordable auto insurance quotes in Texas for your teen is to shop around, leverage available discounts, and work closely with your insurance provider to find the right balance of protection and cost. By taking a comprehensive approach, you can give your teen the freedom to explore the open roads of Texas while providing the peace of mind that comes with reliable and affordable auto insurance.

As your teen ventures forth, embracing the spirit of Texas and the thrill of the open road, you can rest assured that with the right auto insurance coverage, they’ll be equipped to navigate the journey safely and confidently. Take the first step today and secure the best possible protection for your young driver in the Lone Star State.