As a young driver in Florida, finding affordable car insurance can feel daunting. With the Sunshine State boasting some of the highest insurance rates in the country, the pressure to secure the right coverage at the right price can be overwhelming. But fear not, fellow Floridian! I’ve been there, and I’m here to share my insights and strategies to help you navigate this journey with confidence. I’ll guide you through the process of getting auto insurance Florida quotes and finding the best deals.

Understanding Florida’s Graduated Licensing System

Let’s start by diving into the nuances of Florida’s graduated licensing system. As a 15-year-old, I was eager to get behind the wheel and experience the freedom of the open road. But with that excitement came a fair share of restrictions – the learner’s license stage required daytime driving only for the first 90 days and the constant supervision of a licensed driver over 21.

After a year and 50 hours of practice driving (including 10 at night), I was finally able to upgrade to a driver’s license at age 16. This new license came with its own set of limitations, like nighttime driving restrictions and passenger limits. It wasn’t until I turned 18 that I gained the coveted full driving privileges, but throughout that process, I learned the importance of patience, practice, and responsible driving.

You see, Florida’s graduated licensing system is designed to help young drivers like us gain experience safely. And as we navigate these stages, it’s crucial to understand how our age and driving history can impact our auto insurance rates. After all, insurers view younger, less experienced drivers as higher-risk, which can translate to higher premiums.

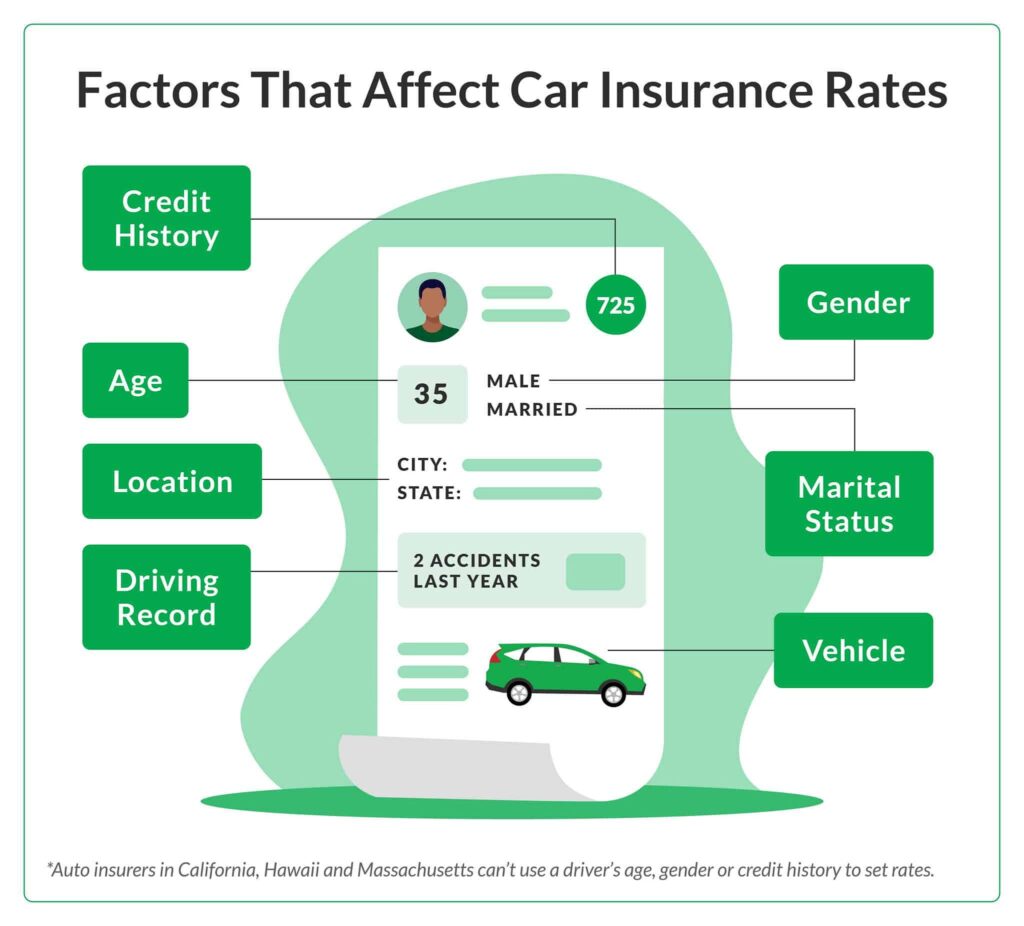

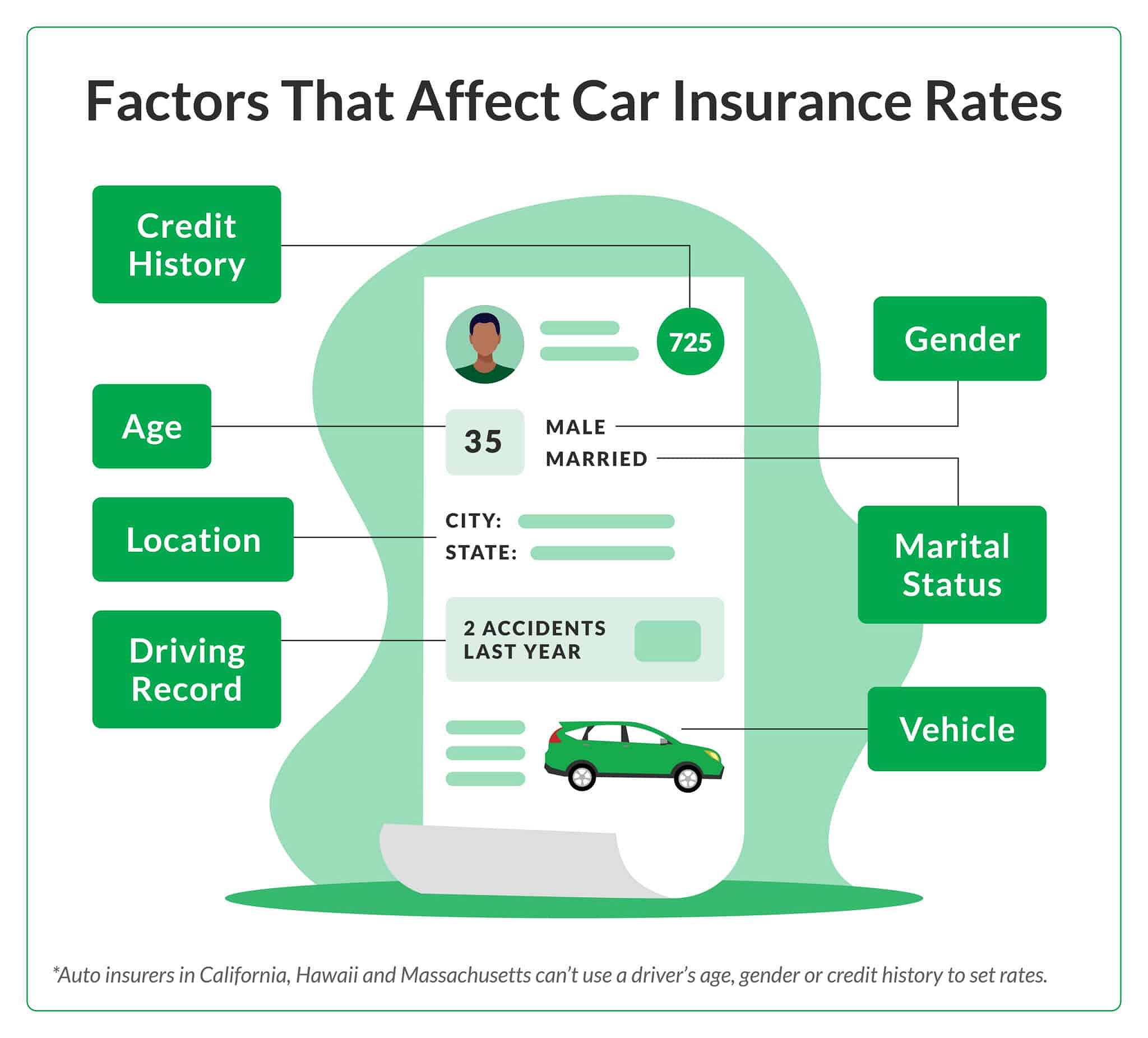

Factors Affecting Auto Insurance Rates for Young Drivers in Florida

Speaking of rates, let’s dive into the key factors that can influence the cost of car insurance for young drivers in the Sunshine State. Age is undoubtedly one of the primary considerations – the younger you are, the more you’ll typically pay. But your driving record also plays a significant role, as any accidents, speeding tickets, or other violations can send your rates skyrocketing.

The type of vehicle you drive is another important factor. As a general rule, more expensive, high-performance cars will cost more to insure than safer, more affordable models. And if you live in a city like Miami or Tampa, you may also end up paying higher rates due to factors like local crime rates and accident frequency.

Believe it or not, your credit score can also come into play. Insurance companies often use this as an indicator of risk, so maintaining a good credit history can help you secure more favorable rates. Demographic factors, such as your gender and marital status, may also influence your insurance costs.

Strategies for Finding the Cheapest Auto Insurance Florida Quotes

Now that we’ve covered the key factors impacting insurance rates, let’s talk about how to find the most affordable auto insurance quotes in Florida as a young driver. The first and most crucial step is to shop around and compare offers from multiple providers. Don’t just go with the first quote you receive – take the time to get quotes from several companies, as rates can vary significantly.

As you’re comparing, be sure to explore any available discounts. Good student, safe driver, and multi-policy discounts can all help lower your overall costs. And don’t be afraid to ask about customized coverage options – some insurers may be willing to tailor a policy to your specific needs and budget.

Another strategy to consider is opting for minimum coverage, which can be more budget-friendly than comprehensive policies. However, it’s essential to weigh the potential risks and ensure you have the necessary protection in case of an accident. Remember, Florida requires all drivers to carry personal injury protection (PIP) and property damage liability insurance, so you’ll need to meet these minimum requirements at a minimum.

And here’s a pro tip: bundling your auto insurance with other policies, such as homeowners or renters insurance, can lead to significant savings. Providers often offer discounts for customers who consolidate their coverage, so exploring this option could be a game-changer for your wallet.

Top Car Insurance Companies for Young Drivers in Florida

As you’re navigating the auto insurance landscape, it’s helpful to know which providers are typically the most affordable for young drivers in Florida. Based on my research and personal experience, here are a few standouts:

State Farm: Known for their excellent customer service and a wide range of coverage options, State Farm is often a top choice for young drivers in the Sunshine State. They offer competitive rates and a variety of discounts, including good student and safe driver incentives. In fact, according to my research, State Farm offers the cheapest full coverage auto insurance in Florida, with an average annual premium of just $1,813.

Geico: Geico is another popular option, renowned for its affordability and user-friendly online tools. They provide a range of coverage choices and frequently have some of the lowest rates for young drivers in Florida. In my experience, Geico has the cheapest minimum coverage policies in the state, with an average annual cost of $682.

Progressive: As a progressive (pun intended) insurance provider, Progressive offers innovative features and personalized coverage options. They’re particularly well-suited for young drivers seeking customizable policies. While not the cheapest overall, Progressive’s average annual full coverage premium of $3,196 is still competitive in the Florida market.

Travelers: Travelers is a financially strong insurance company with a reputation for quality customer service. They offer competitive rates and a variety of coverage choices for young drivers in Florida. With an average full coverage premium of $2,121 per year, Travelers is a solid option for affordable auto insurance in the state.

When comparing these providers, consider factors like average rates, available discounts, customer satisfaction ratings, and the breadth of coverage options to find the best fit for your needs and budget.

Discounts and Savings Opportunities

In addition to comparing rates from different insurers, there are several discounts and savings opportunities young drivers in Florida should take advantage of. One of the most common is the good student discount – if you maintain a strong academic record (usually a B average or higher), you can qualify for significant savings on your auto insurance.

The safe driver discount is another biggie. By avoiding accidents, speeding tickets, and other violations, you can demonstrate your responsible driving habits and earn lower premiums. And if you complete an approved defensive driving course, you may also be eligible for a discount.

Bundling your auto insurance with other policies, such as homeowners or renters insurance, can also lead to substantial savings through the multi-policy discount. And if you’re really looking to get the most bang for your buck, consider enrolling in a usage-based insurance program, like Geico’s DriveEasy or State Farm’s Drive Safe & Save, which can reward you for your safe driving behaviors.

FAQ

Do I need full coverage car insurance in Florida?

While Florida’s minimum insurance requirements include personal injury protection (PIP) and property damage liability, it’s generally recommended to have full coverage, especially for young drivers. Full coverage, which includes collision and comprehensive insurance, provides more robust protection in the event of an accident or other covered incident. However, the decision ultimately depends on your budget and risk tolerance.

What are the best discounts for young drivers in Florida?

Some of the most common discounts available to young drivers in Florida include the good student discount, safe driver discount, multi-policy discount, and defensive driving course discount. By taking advantage of these opportunities, you can significantly reduce the cost of your auto insurance coverage.

How can I lower my car insurance rates as a young driver?

In addition to exploring available discounts, you can try the following strategies to lower your car insurance rates as a young driver in Florida:

- Compare quotes from multiple providers

- Consider raising your deductible to lower your monthly premiums

- Opt for the minimum required coverage, though this comes with more risk

- Maintain a clean driving record and good credit score

- Choose a safer, less expensive vehicle to insure

What happens if I get a speeding ticket or accident?

Receiving a speeding ticket or being involved in an accident can have a significant impact on your auto insurance rates in Florida. Insurers view these incidents as indicators of higher risk, which can result in higher premiums. The exact increase will depend on the severity of the infraction and your overall driving history. It’s essential to maintain a clean record to secure the best possible rates as a young driver.

Conclusion

As a young driver navigating the auto insurance landscape in Florida, I know firsthand how daunting it can be to find affordable coverage. But with the right strategies and a little bit of research, you can absolutely secure the protection you need without breaking the bank.

Remember, understanding Florida’s graduated licensing system, familiarizing yourself with the key factors that influence rates, and exploring every discount and savings opportunity are all crucial steps in your quest for the cheapest auto insurance quotes. And don’t forget to shop around, compare offers from multiple providers, and prioritize safe driving practices.

By following these tips and tapping into the resources available, you can take control of your auto insurance journey and hit the roads of Florida with confidence, knowing you’ve got the coverage you need at a price you can afford. Happy driving, fellow Floridians!