Navigating the world of auto insurance as a new driver can be overwhelming. Auto insurance quotes compare is crucial for finding the best deals and ensuring you have the right coverage.

As a recent college graduate, I’ve been in your shoes, eager to hit the open road but unsure of where to start with car insurance. Drawing on my own experiences and research, I’ve compiled this comprehensive guide to help other new drivers like myself make informed decisions and save money on their auto insurance policies.

Before diving into the quote comparison process, it’s essential to understand the fundamentals of auto insurance. Policies typically include several key coverage types, each serving a specific purpose:

Types of Coverage

- Liability Coverage: Protects you if you’re found at fault for an accident, covering damages or injuries to the other driver and their vehicle.

- Collision Coverage: Pays for repairs to your vehicle in the event of a collision, regardless of who is at fault.

- Comprehensive Coverage: Protects your car from non-collision events, such as theft, vandalism, or natural disasters.

- Uninsured/Underinsured Motorist Coverage: Helps pay for your injuries or damages if you’re hit by a driver with no insurance or insufficient coverage.

- Medical Payments and Personal Injury Protection (PIP): Provide financial assistance for medical expenses and lost wages if you’re injured in an accident, regardless of fault.

Understanding these coverage types and their respective purposes will help you make informed decisions about the right car insurance policy for your needs.

Cheerful man driving a car

Cheerful man driving a car

When it comes to comparing auto insurance quotes, the key is to approach the process methodically. Start by gathering the necessary information, including your driver’s license details, the vehicle you’ll be insuring, and your driving history. This will ensure you receive accurate and personalized quotes from insurance providers.

Next, determine the appropriate coverage levels based on your driving habits, the value of your vehicle, and your financial situation. Remember, state minimum requirements may not provide sufficient protection, so it’s often advisable to purchase more coverage.

To find the best deal, get quotes from at least three to five different insurance companies. Rates can vary significantly between providers, so comparing offers is crucial. When evaluating the quotes, consider not only the price but also the coverage levels, available discounts, and the insurers’ reputations for customer service and claims handling.

Young lady searching for car insurance

Young lady searching for car insurance

Maximizing Savings with Discounts for New Drivers

As a new driver, you may be eligible for various discounts that can significantly lower your auto insurance premiums. Some of the most notable discounts include:

Good Student Discount

Maintaining a strong academic record (typically a GPA of 3.0 or higher) can qualify you for discounts from many insurance providers. Simply provide proof of your grades to take advantage of this perk.

Safe Driver Discount

By developing and maintaining safe driving habits, you can earn discounts from insurers. Avoiding accidents and traffic violations is key to demonstrating your commitment to responsible driving.

Additional Discounts

Explore other potential savings opportunities, such as multi-car discounts, defensive driving course discounts, and discounts for anti-theft devices installed in your vehicle. Thoroughly researching and inquiring about all available discounts can help keep your insurance costs down.

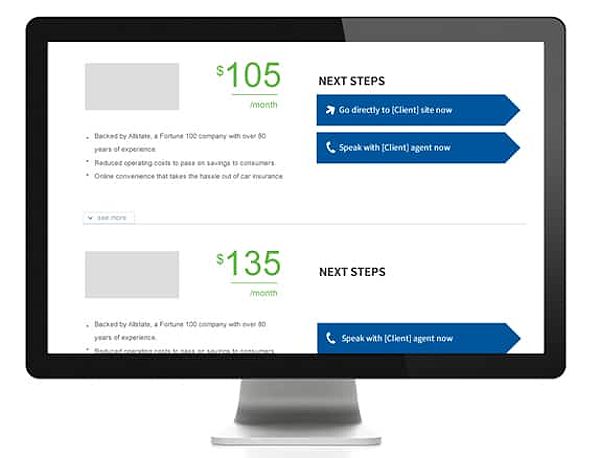

Comparison tool

Comparison tool

Tips for New Drivers: Staying Safe and Saving Money

As you navigate the road ahead, keep these additional tips in mind:

Prioritize Safe Driving Practices

Strictly adhere to traffic laws, eliminate distractions, maintain a safe following distance, and stay acutely aware of your surroundings. Developing these habits not only keeps you and others safe on the road but also helps you qualify for valuable insurance discounts.

Consider a Defensive Driving Course

Enrolling in a state-approved defensive driving course can provide you with advanced skills and knowledge to become a more confident and capable driver. This not only improves your driving abilities but also helps secure additional insurance savings.

Shop Around Regularly

As you gain more experience behind the wheel, make it a habit to periodically review your insurance coverage and compare quotes from multiple providers. Rates and discounts can change over time, and this proactive approach ensures you’re always getting the best deal on your auto insurance.

Establishing a Solid Foundation for the Road Ahead

In addition to the tips mentioned, there are a few more strategies that can help you navigate the auto insurance landscape as a new driver:

Maintain a Clean Driving Record

Prioritize safe driving practices and avoid traffic violations at all costs. A clean driving record not only keeps you and others safe on the road but also helps you qualify for the best insurance rates and discounts.

Review Your Coverage Needs Regularly

As your life and driving needs change, it’s essential to review your auto insurance coverage to ensure it still meets your requirements. Don’t hesitate to shop around and compare quotes annually to ensure you’re getting the best possible deal.

Understand the Impact of Accidents and Tickets

If you do find yourself in an accident or receiving a traffic ticket, be aware of how it can affect your insurance rates. Work with your insurance provider to understand the implications and take steps to mitigate the impact, such as taking a defensive driving course.

FQAs

Q: What should I do if I get a traffic ticket? A: If you receive a traffic ticket, it’s important to address it promptly. Contact your insurance company to understand how the ticket will impact your premiums. Consider taking a defensive driving course, as this may help mitigate the effect of the violation on your rates.

Q: How long does a DUI stay on my driving record? A: A DUI typically remains on your driving record for at least five years. During this time, it can significantly increase your insurance rates, making it crucial to maintain a clean driving history.

Q: What should I do if I’m involved in an accident? A: If you’re involved in an accident, report it to your insurance company as soon as possible. Provide all the necessary details truthfully, and your insurer will guide you through the claims process.

Conclusion

By understanding the fundamentals of car insurance, comparing auto insurance quotes effectively, and taking advantage of available discounts, you can navigate the world of auto insurance with confidence as a new driver. Remember to prioritize safe driving practices, continuously improve your skills, and stay vigilant in reviewing your coverage. With these strategies, you can find the most affordable and comprehensive protection for your needs, both now and in the future.

As you embark on your driving journey, I encourage you to use the tips and insights provided in this guide to make informed decisions about your auto insurance. Comparing “auto insurance quotes” is a valuable tool in finding the best deals and ensuring you have the right coverage to protect yourself and others on the road.

Whether you’re a recent college graduate like myself or a new driver from any walk of life, the key is to approach the auto insurance landscape with a proactive and informed mindset. By doing so, you can save money, stay safe, and enjoy the freedom and independence that comes with being a confident and responsible driver.

As you continue to gain experience on the road, remember that your auto insurance needs may change over time. Stay vigilant, keep comparing quotes, and make adjustments to your coverage as necessary. With the right approach, you can establish a solid foundation for the road ahead and enjoy the rewards of safe and affordable driving.